Political Profiteering

How Forest City Enterprises Makes Private Profits at the Expense of America’s Taxpayers

Part III of III:

Unfair Enrichment: How Forest City Enterprises Acts Above the Law

I. Introduction

A new neighbor has moved to your community. But it is not someone who shares your backyard, a parking space, or neighborhood watch duties. Rather, this neighbor plans to buy the influence of your mayor, your city council member, and your Senator with campaign contributions. He wants his political cronies to declare your neighborhood blighted, and condemn its homes and businesses, so that he can build luxury apartment buildings, shopping centers, and a basketball arena. He wants to congest your streets with thousands of cars and people. And your new neighbor wants you to pay for it. He plans to get millions of dollars in public subsidies, tax breaks, and tax-exempt financing by spending enormous amounts lobbying your representatives in government. Not long after the ink dries on these deals, and public funding is secured, he will sell the development before it is finished, leaving you and your community without the promised public benefits.

Your new neighbor is Forest City Enterprises (FCE), a publicly-traded real estate development company with over $10 billion in assets. Its business model involves getting unfair deals and making huge profits with the political influence it buys with campaign contributions and, if necessary, bribes.

This third and final report is the culmination of Cause of Action’s (CoA) 18-month investigation of FCE, its business practices, and the influence it wields over communities and public officials through enormous political spending and lobbying. This investigation involved thorough statistical analyses of millions of dollars in public subsidies, gross and net profits, and campaign spending in federal, state, and local races across the country. It also required the review of thousands of pages of documents, including legal filings, legal opinions and transcripts; the filing of Freedom of Information Act requests in New York, Texas and the District of Columbia; and telephone and in-person interviews with individuals with personal knowledge of the events that are described herein.

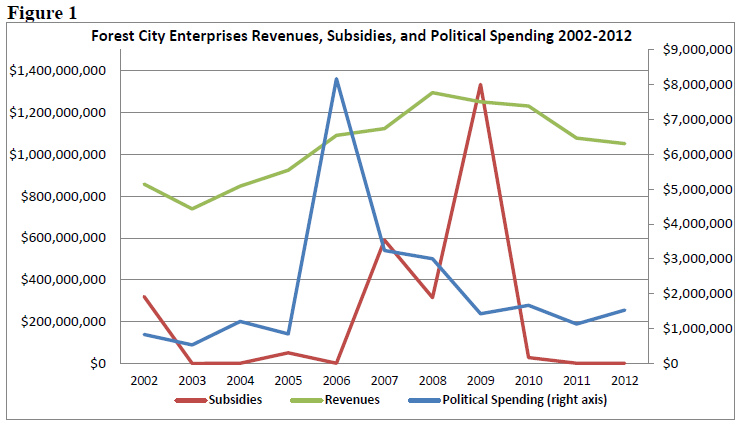

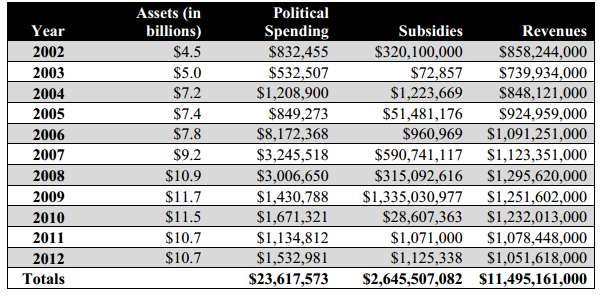

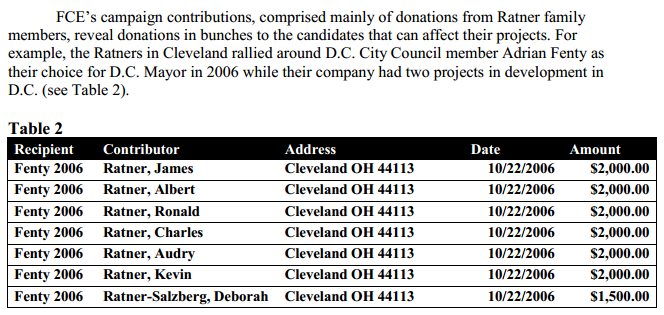

CoA’s first report in this series showed that FCE has a business model that depends upon political profiteering. FCE consistently uses public money and government influence to reap millions in profit. Using highly-paid lobbyists, political connections, campaign contributions, and strategic hiring of government officials, FCE obtains lavish public subsidies, tax-exempt financing, and eminent domain condemnations of private land. Between 2002 and 2012, FCE, its subsidiaries, and its employees spent $23 million on campaign contributions and lobbying at the federal, state, and local level. In return it received 52 direct and indirect government subsidies or financial benefits totaling at least $2.6 billion. These subsidies amounted to 23% of FCE’s $11.4 billion revenue during that time.

In its second report, CoA exposed FCE’s pattern of promising local governments that its development projects would generate plentiful jobs, housing, economic development, and tax revenues. However, once FCE receives public financial support, it often renegotiates or delays implementation of the benefits that it has promised. FCE promised to create more than 70,000 permanent jobs and 3,750 affordable housing units for projects in Brooklyn and Albuquerque, but has actually produced only 3,000 permanent jobs, in total, and built no affordable housing units. Meanwhile, FCE took in $277.2 million in public subsidies from those communities after contributing $310,450 to local political candidates and spending over $8.6 million on lobbyists. In short, FCE lobbies, profits, and then bilks taxpayers by breaching its promises to the community.

This final report details ways in which FCE violated federal law, took advantage of manipulated census data, and poured hundreds of thousands of dollars into funding ballot initiatives supporting eminent domain for private use. FCE’s New York subsidiary, Forest City Ratner (FCR), appears to have violated federal regulations in order to attract foreign investors to support its $4.9 billion Atlantic Yards development in Brooklyn. It took advantage of a federal immigration program using manipulated unemployment data and misleading advertising. In 2012, when the Department of Justice secured convictions of local politicians involved in a bribery scheme that was hatched to get approval of FCR’s development in Yonkers, N.Y., the evidence at trial clearly showed that at least two FCR executives were also involved. Yet, despite this evidence, no one at FCR was ever prosecuted. Finally, FCE has benefited from, and actively lobbied to expand, the government’s condemnation of property for private development using eminent domain, the power that allows government to take private property for public use. All of these activities show that FCE has ignored or subverted legal norms in order to maximize its profits.

While FCE continually looks for opportunities to expand its enterprise across the country, the company and its executives often employ nefarious schemes in order to secure the land, money, and votes needed to secure multi-million dollar development contracts. In sum, FCE exploits political connections for enormous profits and fails to follow the law—the epitome of political profiteering.

II. Findings

Attracting Investors by Manipulating Unemployment Data: Atlantic Yards And the EB-5 Visa Program

- Finding: The New York Department of Labor (NYDOL) and the Empire State Development Corporation (ESDC) manipulated census data in order to create a “targeted employment area” for the New York City Regional Center (NYCRC) and Forest City Ratner (FCR) in violation of U.S. Citizenship & Immigration Services (USCIS) regulations.

- Finding: FCR and NYCRC, with the cooperation of New York elected officials, misleadingly advertised the Atlantic Yards Project to potential investors by keeping the actual purpose of EB-5 funding ambiguous and exaggerating job creation predictions. Moreover, FCR misled the public by promising that EB-5 would create a substantial number of jobs, despite ESDC predictions to the contrary.

- Finding: Job statistics for the Atlantic Yards Project are not based on actual numbers but on estimates derived from economic models and “reasonable methodologies.” Nevertheless, due to questionable USCIS rules, Atlantic Yards EB-5 investors received credit for job creation.

- Finding: The job creation predictions for the Atlantic Yards Project appear to violate federal securities law. Moreover, NYCRC contracted the same immigration lawyer and economist as GreenTech Automotive, another crony corporation currently under investigation by the Securities and Exchange Commission.

Anatomy of a Bribe: Forest City Ratner and the Ridge Hill Development

- Finding: The Department of Justice (DOJ) failed to prosecute FCR executives who bribed Yonkers City Council Member Sandy Annabi. FCR executives covered up payments to Yonkers Republican Party Chairman Zehy Jereis under the guise of a consulting contract for “retail hunting” in order to protect themselves from federal criminal liability when, in fact, Jereis’s consulting contract was in exchange for Annabi’s vote approving FCR’s Ridge Hill project. FCR executives made false promises and used political pressure to influence Annabi.

- Finding: Evidence at trial showed that Bruce Ratner appears to have participated in the bribery scheme because he gave Jereis the consulting job.

- Finding: In 2010, two Members of Congress wrote to U.S. Attorney Preet Bharara about concerns that political favoritism affected DOJ’s decision not to prosecute FCR. CoA’s investigation reveals that FCE and members of the Ratner family have connections with noteworthy political appointees in the Obama Administration’s Department of Justice, including the U.S. Attorney General. They made substantial campaign contributions to the Democratic Party and Democratic candidates in New York.

Public Seizures for Private Benefits: Atlantic Yards and Eminent Domain

- Finding: FCE defended and benefited from eminent domain seizures for private development in California and New York. FCR benefited from eminent domain seizures for its Atlantic Yards Project and New York Times Building. FCE’s California subsidiary, Forest City Residential West (FCRW), benefited from eminent domain seizures for The Uptown project in Oakland. FCRW spent a combined $350,000 on California ballot initiatives in 2006 and 2008 to protect broad eminent domain powers that benefit private developers.

Figure 1: The Atlantic Yards Project Targeted Employment Area for EB-5 violates USCIS regulations by crossing all existing political boundaries

(click to enlarge)