Earlier this month, Cause of Action Institute joined more than 20,000 members of the fishing industry from across the globe at the 2019 Seafood Expo North America in Boston. For years, Cause of Action has monitored and brought legal challenges against the overregulation of our nation’s fisheries and its negative economic impact on fishing communities – especially small business and family owned operations. However, after three days of speaking with industry insiders last week, the breadth of the harm caused by administrative state overreach continues to appall us.

We spoke with people from nearly every corner of the seafood industry who are severely impacted by the government regulations that plague this field: trade restrictions such as tariffs or quotas, the cost of complying with regulations such as the Jones Act, one size fits all or outdated regulations that benefit certain companies at the expense of others, and offshore development that has the potential to bring many companies’ business to a standstill. Many of the visitors we engaged with were small business owners who fear regulations like industry-funded monitoring will run them out of business entirely.

Cause of Action was fortunate to be able to reconnect with former clients David Goethel and John Haran. For David, John, and many members of their respective communities, fishing is not only their livelihood, but also a large part of the culture of their respective communities. When faced with economic devastation from regulations like the Omnibus Amendment, the way of life that communities have spent years building is also threatened with destruction.

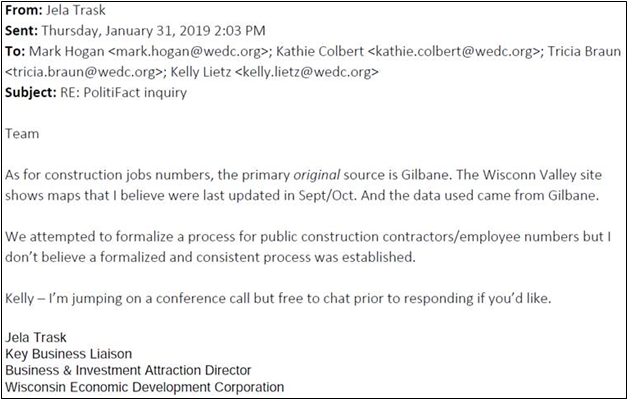

Cause of Action Staff with former client David Goethel

Stories like those we encountered last week serve as an important reminder of the direct consequences posed by arbitrary and excessive executive power. American’s should be free to live prosperous lives and reach their highest potential without the interference of an overbearing administrative state, and Cause of Action looks forward to continuing to strive towards this goal in the commercial fishing industry, among many other affected fields.

–

Mallory Koch is a communications associate at Cause of Action Institute.