In a major win for oversight and constitutional governance, the White House Office of Management and Budget (“OMB”) and the Department of the Treasury have scrapped a decades-old agreement that exempted many IRS tax regulations from independent review and oversight. In its place, the agencies have set up a new agreement that requires Treasury to submit important tax regulations to OMB’s Office of Information and Regulatory Affairs (“OIRA”) for review pursuant to Executive Order 12,866 (“EO 12,866”) just like nearly every other agency.

This change came after an investigative report from Cause of Action Institute and a sustained campaign over the past few months from supporters of OIRA review. From a transparency perspective, this agreement is already an improvement because it has been announced publicly, posted on Treasury’s website, and not kept secret for thirty-five years, like the previous agreement.

The New Memorandum of Agreement

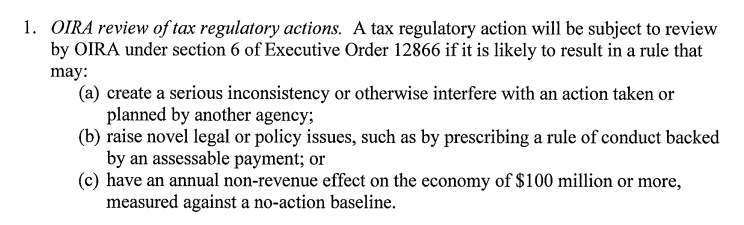

The new agreement will require Treasury to submit the following categories of tax regulations to OIRA for review:

All three categories are well conceived. First, one of the main focuses of OIRA review has always been interagency consultation. And IRS rules can overlap with rules from the Department of Labor and, increasingly in the wake of the Affordable Care Act, the Department of Health and Human Services. Allowing those and other agencies to weigh in on proposed tax regulations is an appropriate and necessary level of oversight, and can lead to better policymaking. At the Senate hearing where the agreement was unveiled, Senator Lankford asked Treasury General Counsel Brent McIntosh who will make the determination of whether a new rule is likely to create a conflict with another agency. McIntosh replied that, under the agreement, Treasury will submit a list of rules to OIRA on a quarterly basis and OIRA will then be in a position to flag rules that may create a conflict.

Second, Treasury will send OIRA tax regulations that raise novel legal or policy issues. These are exactly the type of rules should not be decided in a vacuum and when independent review from OIRA and others can provide a fresh look at novel questions. This is also an existing category of rules that are covered by EO 12,866 and so it makes sense to include tax regulations in this existing mandate.

Third, and finally, the new agreement includes tax regulations that are likely to have an annual non-revenue impact on the economy of $100 million or more. This is the existing threshold for significant regulatory actions for other agencies. The agreement makes a distinction for the “non-revenue” impact of tax regulations. This is a commonsense distinction because OIRA review and cost-benefit considerations should be focusing on the distortionary impacts of regulatory choices, not money transferred to the fisc. This modification of the existing language in EO 12,866 was necessary to fit the existing system to the way tax regulations work. At the hearing, Senator Lankford asked McIntosh which rules from the 2017 tax cuts may meet this threshold. McIntosh estimated that rules related to pass-through entities, interest expense deductions, bonus depreciation, section 199A, partnerships under section 512, and section 951A could now be subject to OIRA review.

The New MOA Puts OIRA in Control

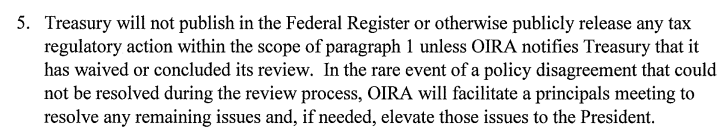

The new agreement includes an important provision that bars Treasury from rushing rules out the door to the Federal Register before OIRA has signed off.

In order for the president and the White House to properly oversee the Executive Branch, they must be able to control its regulatory actions. This provision makes it explicit that OIRA gets the final say.

Agreement Addresses Concerns about Delay and Expertise

Perhaps the biggest pushback against subjecting tax regulations to the same review that applies to other agencies’ rules was concerns about delay. The new agreement addresses that issue by putting a 45-day clock on OIRA review and a special 10-business-day expedited review for rules stemming from the 2017 tax cuts. Responding to concerns about OIRA’s expertise, Administrator Naomi Rao announced that Minnesota Law Professor and tax administration expert Kristin Hickman was joining OIRA as an advisor. And OMB has been staffing up on other tax experts as well.

Concerns about the New Agreement

There is at least one concern about the agreement. It only applies to “tax regulatory actions,” which the agreement gives the same meaning as “regulatory actions” in EO 12,866. That definition covers “any substantive action by an agency (normally published in the Federal Register) that promulgates or is expected to lead to the promulgation of a final rule or regulation, including notices of inquiry, advance notices of proposed rulemaking, and notices of proposed rulemaking.” Noticeably absent from this definition are interpretative rules that are not published in the Federal Register. The IRS is notorious for trying to claim that its rules are interpretative and do not need to follow the strictures of the Administrative Procedure Act. (CoA Institute recently filed an amicus brief in a case challenging this behavior.) It remains to be seen whether the IRS and Treasury will try to assert that interpretative rules do not meet the definition of a “regulatory action” under EO 12,866 and thus do not need to be sent to OIRA for review. A fair reading of the term “regulatory action” should include interpretative rules, even under the IRS’s improperly broad definition of that term.

But overall a dramatic improvement in the oversight of tax regulations and milestone in the project to end so-called tax exceptionalism and bring IRS under the same administrative law as everyone else.

James Valvo is Counsel and Senior Policy Advisor at Cause of Action Institute. He is the principal author of Evading Oversight. You can follow him on Twitter @JamesValvo.