Cause of Action Institute recently received documents indicating that a repeat customer and vocal supporter of the Export-Import Bank of the United States (“EXIM”) allegedly defrauded the bank. EXIM, which is tasked with assisting the financing of U.S. exports, has gained a reputation for favoring certain companies over others, which is exemplified by its nickname “the Bank of Boeing” for its preferential treatment of the airline. Recent reports from the Government Accountability Office and the EXIM Inspector General (”IG”) have also shown a disconcerting susceptibility to fraud.

Search Results for: inspector general

Sensitive Review

“Sensitive review” refers to the practice of giving certain Freedom of Information Act (FOIA) requests extra scrutiny. This often takes the form of an additional layer of review or “consultation” before records are released. It may involve special tracking and “awareness” alerts for requests submitted by frequent requesters or representatives of the news media. Requests may even be flagged for sensitive review simply because they implicate records that are likely to solicit media attention once disclosed. The process may involve an agency’s public affairs team or other communications specialists, and it frequently includes political appointees, too. Sensitive review almost always delays and sometimes prevents the disclosure of records that the public has a right to see.

Cause of Action Institute has been investigating sensitive review across the federal government since 2013. Our work has uncovered troubling developments at more than twelve agencies. The content below provides an overview of our work.

Sensitive review has become an entrenched agency practice regardless of which party or president is in power. Although alerting or involving political appointees or career communications staff in FOIA administration does not violate the law per se—and may, in rare cases, be appropriate—there is never any assurance that the practice will not lead to severe delays of months and years. At its worst, sensitive review leads to intentionally inadequate searches, politicized document review, improper record redaction, and incomplete disclosure. When politically sensitive or potentially embarrassing records are at issue, politicians and bureaucrats will always have an incentive to err on the side of secrecy and non-disclosure.

Department of Homeland Security

- Oct. 20, 2017 – DHS Watchdog Claims Political Appointees No Longer Politicizing FOIA

- Dec. 21, 2018 – CoA Institute Discovers Curious DHS FOIA Notification Process for Employee Records

Department of Defense

- Dec. 2012 – Departmental Situational Awareness Process for Significant DoD FOIA Responses

- July 9, 2013 – Secret Pentagon policy may delay responses to Freedom of Information Act requests

- Aug. 2018 – Departmental Level Notification Process for Significant DoD FOIA Requests and Responses

- Aug. 8, 2018 – DoD Watchdog Details Agency’s Failure to Address FOIA Shortcomings

Environmental Protection Agency

- Dec. 19, 2017 – Politicizing FOIA review at the EPA and Interior

- May 14, 2018 – Politics Clouding Criticism of the EPA’s Heightened Sensitive Review FOIA Procedures

- July 16, 2018 – EPA Chief of Staff describes agency’s sensitive review process for “politically charged” FOIA requests

- July 19, 2018 – EPA responds to House OGR Democrats, arguing FOIA “sensitive review” originated with the Obama Administration

Federal Aviation Administration

Department of Housing and Urban Development

- July 31, 2013 – FOIA Follies: HUD Flags Sensitive Freedom of Information Act Requests for Extra Scrutiny; Political Appointees Involved

Department of the Interior

- Dec. 19, 2017 – Politicizing FOIA review at the EPA and Interior

General Services Administration

Internal Revenue Service

National Oceanic and Atmospheric Administration

- Dec. 11, 2017 – COA NOAA Sensitive Review FOIA Request

- Mar. 12, 2018 – NOAA Records Demonstrate Expansion of Sensitive Review FOIA Procedures

Department of Treasury

- June 20, 2013 – Cause of Action Memos Impugn Obama Transparency Pledge

- June 24, 2013 – White House and Treasury Department Politicize FOIA

- Nov. 1, 2016 –CoA Institute Sues Treasury for “Sensitive” Records Concealed from Public Disclosure

Department of Veterans Affairs

- Aug. 1, 2018 – VA Sensitive Review FOIA Request

- Aug. 1, 2018 –Democratic Senators Seek Records about “Sensitive Review” from VA, Ask Inspector General to Open Investigation into FOIA Politicization

- Aug. 16, 2018 – VA Sensitive Review FOIA Appeal

- Aug. 16, 2018 – Department of Veterans Affairs Discloses 2014 Guidance on Intra-Agency Consultations for FOIA Requests of “Substantial Interest” to Agency Leadership

- Dec. 12, 2018 – Investigation Update: VA releases 2014 memo on “sensitive review,” but fails to conduct an adequate search for more recent FOIA guidance

- August 9, 2019 – Investigation Update: The VA continues to subject certain FOIA requests to “sensitive review,” but the agency is keeping records about the practice secret

White House/ Office of the White House Counsel

Related Work

Definition of a record

- Feb,. 8, 2017 – Defining a “Record” under FOIA

- Oct. 18, 2018 – Cause of Action Institute Lawsuit Seeks to Overturn DOJ’s restrictive FOIA guidance

Sensitive Review Guidance Memos

Investigation Update: GSA Continues to Block Disclosure of White House Directive on Congressional Oversight Requests, Reveals Sensitive Review Procedure for Media Requesters

Cause of Action Institute (CoA Institute) received an interim response yesterday from the General Services Administration (GSA) on a Freedom of Information Act (FOIA) request that suggests the agency is deliberately stonewalling the release of a White House directive instructing agencies on how to respond to congressional oversight requests. Records released by the agency also suggest that the GSA has implemented a “sensitive review” FOIA process by which news media requesters are subject to an extra layer of pre-production review.

Newly Released Records Confirm IRS, DOJ Violated Taxpayer Confidentiality Law

Whether we like it or not, the Internal Revenue Service (IRS) plays a central role in the administration of our tax laws. The agency consequently possesses copious amounts of sensitive financial information about individual Americans, nonprofits, and other corporations. Congress considered the protection of such information so important that it has mandated its confidentiality. Section 6103 of the Internal Revenue Code requires that “returns and return information”—essentially, anything about a taxpayer in IRS files—“shall remain confidential.” The importance of taxpayer confidentiality, and the danger inherent in its unauthorized disclosure, is one reason why the 2010 “Tea Party” targeting scandal was so serious—the Obama White House weaponized the IRS to target individuals and nonprofit groups based on their perceived political alignment.

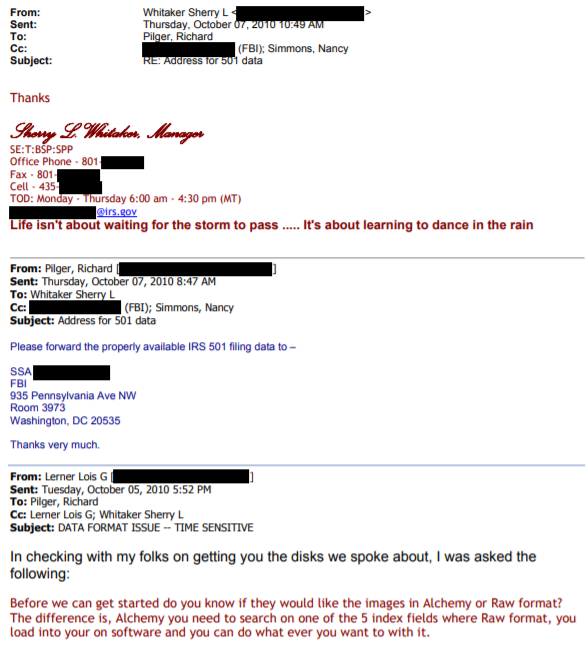

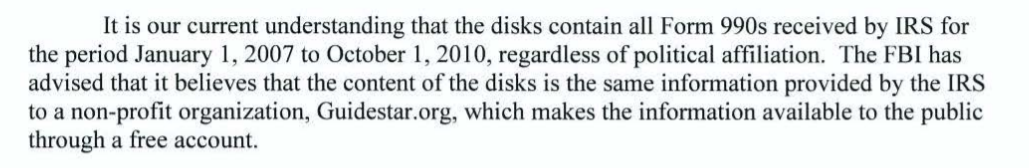

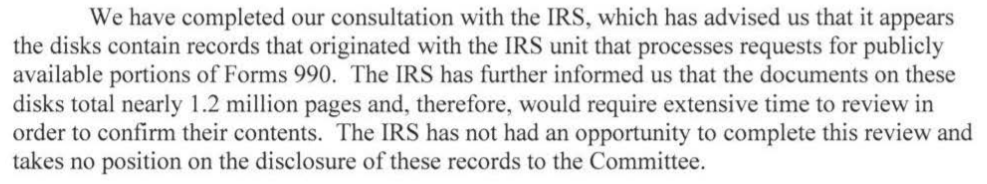

IRS records recently produced to Cause of Action Institute (CoA Institute) in a Freedom of Information Act (FOIA) lawsuit now shed further light on how carelessly the IRS and the Department of Justice (DOJ) handled sensitive taxpayer information and only belatedly admitted to Congress that they had violated taxpayer confidentiality. In 2012, CoA Institute began its in-depth investigation into the nature and causes of the IRS targeting scandal and the misdeeds of government bureaucrats such as Lois Lerner. Part of our investigation revealed that IRS officials, including Ms. Lerner, willingly handed over twenty-one computer disks, containing over 1.1 million pages of taxpayer information, to the DOJ Public Integrity Section and the Federal Bureau of Investigation (FBI), despite lacking proper legal authorization to do so. This allegedly was done as part of the previous Administration’s efforts to investigate exempt entities suspected of having engaged in prohibited political activity.

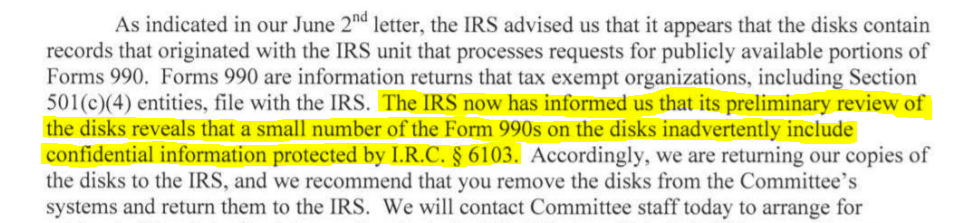

After repeatedly insisting that it had received only “publicly available portions” of Form 990s when the IRS turned over those 1.1 million pages of taxpayer information, the DOJ later admitted it was mistaken. The records received by CoA Institute confirm that was the case.

In two requests for investigation (here and here), CoA Institute explained why the IRS’s unauthorized disclosure constituted a serious breach of taxpayer confidentiality laws. But the DOJ Inspector General, while admitting that taxpayer data had been mishandled, choose to do nothing and merely stated that Congress had been “informed” and “this matter does not warrant further investigation.” The DOJ watchdog’s inaction led to a series of further FOIA requests (here, here, and here) that were designed to discover more about what the IRS and DOJ had done, and how Congress was alerted to the violation of Section 6103. CoA Institute obtained the requested records only after filing a lawsuit to compel disclosure.

Section 6103 sets out clear rules for the handling of tax information. Those rules are in place to protect taxpayer privacy. In this case, however, the rules were not followed. The DOJ never had proper authorization to obtain the nonprofits’ tax information, including information about donors. But the IRS nevertheless transferred 1.1 million pages of returns to the DOJ and agreed to provide the data in “raw” format, so that it would be easier for the FBI to process.

On May 29, 2014, after the U.S. House of Representatives Committee on Oversight and Government Reform opened an investigation into the unauthorized transfer of these tax returns, the DOJ claimed that it had obtained only publicly available information, such as the returns available online on Guidestar.org.

Days later, on June 2, 2014, the DOJ again argued that the trove of tax information it obtained from the IRS was not confidential.

And then, only two days after that, the DOJ changed its story—the agency admitted that the IRS had discovered confidential Section 6103 information within the 1.1 million pages of returns and return information. The DOJ claimed that the disclosure had been “inadvertent,” and it indicated that it was “returning [its] copies of the disks to the IRS[.]” Unfortunately, it is impossible to judge just how serious this “inadvertent” breach of confidentiality was because the DOJ has refused to furnish the House Oversight Committee with internal correspondence about the incident. It has withheld this correspondence by citing the deliberative process privilege—a species of executive privilege— and, to date, those records remain secret.

To be clear, by returning the twenty-one CDs to the IRS and informing Congress about what happened, the DOJ followed proper procedure. But that does not exonerate the federal government for having allowed the breach of taxpayer confidentiality to have happened in the first place. All citizens deserve to know their government does not act with political motivations, and that the IRS will safeguard sensitive taxpayer information, especially as it pertains to charitable giving and the operation of nonprofit entities.

The DOJ’s delayed disclosure of records, which finally give a complete picture of what happened, also illustrates another danger of politicization, namely, of the FOIA process. In this case, the DOJ put up so many hurdles to accessing these records that it required a lawsuit to compel disclosure. Even then, it took months for the agency to produce the records. It would have been next to impossible for an ordinary citizen to get the same result.

For government to be truly transparent, it must be held accountable by its citizens. The behavior of the IRS and DOJ in this case is a perfect illustration of why CoA Institute is committed to fighting for an open and transparent government. Government agencies should not be allowed to violate statutes and then stonewall requests that seek to expose the truth. That is why we pursued this investigation and why we will continue to vigorously serve as a government watchdog on behalf of every American.

Ryan Mulvey is Counsel at Cause of Action Institute.

CoA Calls on IG to Investigate Use of Government Owned Vehicles at EXIM Bank

Cause of Action Institute (CoA Institute), a nonpartisan government watchdog organization, sent a letter today to the Office of Inspector General (OIG) at the Export–Import Bank of the United States (EXIM Bank), requesting the EXIM Bank’s Inspector General investigate the use of government owned vehicles by EXIM Bank staff based on documents uncovered by Cause of Action Institute through a freedom of information request. The newly released documents reveal troubling evidence of EXIM Bank staff abusing the use of government owned vehicles.

Kevin Schmidt, director of investigations at Cause of Action Institute issued the following statement:

“We’re calling on the EXIM Bank’s Office of Inspector General to launch an investigation into what appears to be ongoing abuse and use of government vehicles by Bank staff.

“As a result of our own independent investigation, we’ve discovered what appears to be unauthorized use of government vehicles by Bank staff, lack of details in automobile use logs that are required under EXIM Bank policies, including staff leaving off the purpose for the use of government owned vehicles.

“As a financial institution with the power to hand out billions of dollars in federally subsidized and backed loans to corporations, all taxpayers should be concerned that the bank staff cannot seem to follow standard government automobile use protocols that are designed to prevent abuse and protect tax dollars.”

EXIM Bank’s OIG had previously investigated this matter in 2016, producing a report that included a detailed list of deficiencies by the Bank and Bank staffs’ use of government owned vehicles.

Letter and exhibits to the EXIM Bank’s Office of Inspector General

2019.4.3 FOIA Request to Ex-Im Bank Vehicle Use

Cause of Action Institute Secures Rare Preservation Order in Fight to Obtain DOJ Records Created on Personal Email Account

Government official caught using personal email to conduct official business ordered to maintain copies of all records in Gmail account

Washington, D.C. (April 26, 2019) – Cause of Action Institute (CoA Institute), a nonpartisan government watchdog organization, today announced it had secured a rare federal court order requiring a former U.S. Department of Justice (DOJ) employee to preserve the contents of her personal email account, which had been used to conduct official agency business. Those records may be subject to later release.

Ryan Mulvey, counsel for CoA Institute, issued the following statement:

“Government transparency is a fundamental necessity in a free and open society. The use of personal devices to conduct official business remains a serious concern, resulting in records being lost, unsecured, or improperly destroyed. In some cases, personal email accounts are used to avoid disclosure altogether. This court order is an important reminder to all government employees to avoid using personal email and devices and adhere to all relevant agency rules and government transparency statutes. It also is a warning to agencies to ensure that they meet their record-keeping obligations.”

U.S. District Court Judge Amit Mehta granted Cause of Action’s motion, ordering the U.S. Department of Justice to require a former employee, Sarah Isgur Flores, not to delete any emails stored in her personal Gmail account, and to store copies of the account’s contents onto a thumb drive or other storage device, including all emails in archived or deleted folders. The Court also ordered Ms. Flores to maintain the emails until further instructed, and gave the U.S. Department of Justice until May 2, 2019 to provide notice of its compliance with the preservation order. Although the issuance of such a preservation order is rather rare, it is the latest example in a developing trend. Federal courts have become increasingly concerned about the use of personal email to conduct agency business, and they are taking serious the possible loss or destruction of government records that may be subject to the Freedom of Information Act (FOIA) and other federal records management statutes, including the Federal Records Act.

Background

In 2017, media reports indicated that Sarah Isgur Flores, then-spokeswoman for Attorney General Jeff Sessions, used her personal email to issue official statements on behalf of the government. Due to concerns that this sort of behavior could harm the public’s access to official records, and in light of past instances of personal email having been used as a way to conceal public information, Cause of Action Institute filed a FOIA request for Ms. Flores official work-related emails sent or received through her personal devices or accounts. After waiting more than 18 months for a response, CoA Institute sued DOJ to force the disclosure of the Flores records.

On September 27, 2018, DOJ responded, “As is evident from the enclosed records, Ms. Flores forwarded emails sent to her personal account to her official Department of Justice email account, including through an automatic forward. As such, all of these emails were located pursuant to our search of Ms. Flores’ official Department of Justice email account.”

However, within the 112 pages produced by DOJ, the original email issued by Ms. Flores, as reported by members of the press, was missing. Despite raising this issue with DOJ, the government insisted the 112 pages were a full-and-complete record. As a result, and after learning of Ms. Flores’s departure from public service, CoA Institute filed a motion, urging the court to compel DOJ and Ms. Flores to preserve all relevant records.

Late on Thursday, April 25, the Court granted CoA Institute’s motion in full, compelling the government to coordinate with Ms. Flores to preserve her personal email account and maintain copies pending further court proceedings.

-30-

CoA Institutes’s Motion for Preservation Order

Federal Court’s Order for Preservation of Records

Related Stories:

- Records Show How Former FBI Director James Comey Misled the DOJ Inspector General About His Personal Email Use

- Federal Judge Confirms Agencies’ FRA Record Recovery Efforts Must Include Reaching Out to Third-Party Email Providers

- Federal judge rejects DOJ’s use of attorney-client, deliberative process privileges to hide communications with the White House Counsel from public disclosure

- CoA Institute opens government-wide investigation into agency implementation of the FOIA’s “foreseeable harm” standard

- Cause of Action Institute Submits Comment Criticizing Proposed Revisions to Department of the Interior’s FOIA Regulations

- CoA Institute Sues OMB, Compelling it to Take Transparency Policy Seriously

- Cause of Action Sues Commerce Dept. for Failing to Release Auto-Tariff Report

Busted During Sunshine Week: EPA Employees Still Appear to be Using Unauthorized Messaging Applications

Cause of Action Institute Urges Chairman Cummings to Investigate EPA Employees’ Violation of Disclosure & Records Retention Laws

Cause of Action Institute (CoA Institute), a nonpartisan strategic oversight group, sent a letter to U.S. Rep. Elijah Cummings, chairman of the U.S. House Committee on Oversight and Reform (Oversight Committee), on the eve of the committee’s hearing on transparency, to urge Chairman Cummings to investigate government employees using unauthorized messaging applications on their government devices to avoid and/or prevent disclosure, as required under federal law.

“We applaud Chairman Cummings for his commitment to government transparency and urge him to use the powers of his committee to determine why government employees can ignore government policies and federal law and use unauthorized messaging applications that thwart disclosure of government business,” said James Valvo, counsel and senior policy advisor at Cause of Action Institute. “The EPA promised it would clean up its act and eliminate unauthorized apps installed on government devices, but our investigation has found the EPA may have failed to take the necessary action, as a result, these unauthorized apps pose considerable harm to enforcing federal disclosure laws.”

By letter, the EPA informed the National Archives and Records Administration (NARA) that as of June 2018, the EPA had “completed its process” of disabling downloads of unauthorized applications subject to two minor exceptions, and removed most previously installed applications. However, CoA Institute uncovered evidence that 62.16 percent of all apps installed on EPA-furnished devices were unapproved applications, including the non-work-related or encrypted messaging applications that violate record retention and disclosure laws.

Cause of Action Institute, by letter, informed Chairman Cummings of this information in order to assist the Oversight Committee’s duty to reign in government abuses. CoA Institute also informed NARA and the EPA Inspector General of the findings.

The letter we sent to Chairman Cummings can be found below.

Background on our investigation can be found here and here.

Loading...

Loading...