Cause of Action Institute recently received documents indicating that a repeat customer and vocal supporter of the Export-Import Bank of the United States (“EXIM”) allegedly defrauded the bank. EXIM, which is tasked with assisting the financing of U.S. exports, has gained a reputation for favoring certain companies over others, which is exemplified by its nickname “the Bank of Boeing” for its preferential treatment of the airline. Recent reports from the Government Accountability Office and the EXIM Inspector General (”IG”) have also shown a disconcerting susceptibility to fraud.

Wisconsin’s Foxconn Deal Illustrates the Dangers of Corporate Welfare

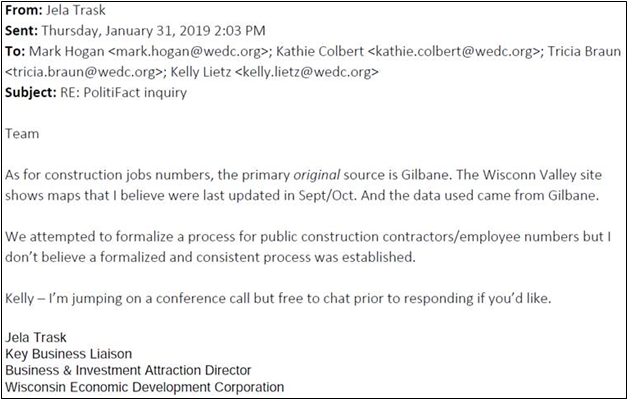

Corporate welfare undermines the economic liberties of individuals, entrepreneurs and innovators by creating a two-tiered society where the government creates a special set of rules and benefits for favored companies. Recently released documents obtained from a Wisconsin Public Records Request reveal that while many of Foxconn’s tax incentives are tied to employment numbers, the Wisconsin Economic Development Council (WEDC) has no formal process for checking construction employment numbers and has to rely on reports compiled by Foxconn’s construction company. The Foxconn deal in Wisconsin illustrates the dangers of corporate welfare and perfectly sums up why Cause of Action Institute is dedicated to exposing these deals and informing citizens of the risks associated with tax incentives and subsidies designed to benefit a single exclusive company.

How did this all begin? Then Wisconsin Governor Scott Walker promised to bring thousands of blue-collar manufacturing jobs back to state, and in July 2017, Walker signed a deal with Foxconn, one of the largest technology providers in the world. Foxconn promised to invest over $10 billion in Wisconsin and create up to 13,000 jobs by 2022, three-fourths of which would be in manufacturing. As a short-term goal, Foxconn promised to create 5,200 jobs by 2020. In exchange, Walker promised $4.5 billion in subsidies and other benefits. At the time, President Trump touted this extravagant corporate welfare deal as “the eighth wonder of the world,” and supportive Wisconsin legislators declared that it would bring economic prosperity to Wisconsin.

Almost two years later, however, the rosy picture painted by Wisconsin lawmakers has yet to materialize. In late 2018, Nikkei Asian Review wrote that Foxconn was planning on cutting 100,000 jobs worldwide due to global economic uncertainty. Then, Louis Woo, one of Foxconn’s lead negotiators on the deal, announced that they were scrapping plans to build a factory, saying “We can’t compete.” Instead of building a manufacturing facility in Wisconsin, as promised, Foxconn shifted to building research and development facilities expected to employ substantially fewer people from a categorically different labor pool.

Crucially, much of the subsidies promised to Foxconn are tied to the company meeting agreed-upon employment numbers. However, documents also reveal that WEDC does not have any formal process for verifying Foxconn’s construction job numbers, despite the fact that WEDC’s website claims credit for the project supporting “10,000 construction jobs in each of the next four years.” Instead, it must rely on Foxconn’s construction management company, Gilbane, to report the job numbers to them. WEDC CEO Mark Hogan said in emails that the WEDC “would only have to verify job creation by a sample of job creation data and signed statements from the company.” As if this weren’t bad enough, Wisconsin’s legislature also has no way to determine what jobs Foxconn employees are doing. In a letter to the state legislature’s leadership, several members of Wisconsin’s state senate and house of delegates said “The company has never explained what the 178 employees in Wisconsin are doing now.” For such a huge deal, there is a staggeringly low amount of oversight.

Unless Foxconn hits its hiring targets, it won’t see much of the $4.5 billion subsidy package, but the state and local governments, as well as the nearby communities, have already paid significant costs. In order to secure the necessary land for the Foxconn campus, the village of Mount Pleasant exercised eminent domain to force village residents out of their homes. Mount Pleasant and Racine County have spent over $130 million to prepare for Foxconn construction, and the state of Wisconsin has spent an estimated $120 million on road construction in the nearby area.

When the deal was originally signed, the non-partisan Wisconsin Legislative Fiscal Bureau (WFLB) reported that even in the absolute best-case scenario, where all the workers employed by Foxconn live in Wisconsin and all the money spent by Foxconn stays in Wisconsin, the state government would not see any return on its investment until the year 2042. In the same study, WFLB estimates that around 10 percent of people employed by Foxconn in Wisconsin will be filled by Illinois residents, pushing the break-even point back to 2045. In February 2018, Tim Bartik, a senior economist at the W.E. Upjohn Institute, told Bloomberg that Wisconsin will never see a return.

Drawing a big company to invest in a particular region can be an exciting proposition for state and local politicians enticed by the prospect of increased employment and economic activity in their state or town. However, when these deals are made final, they often cost more in tax money than they generate. In Wisconsin, the state and local governments proved willing to use every means at their disposal, including the seizure of private property, to try to convince Foxconn to build a multibillion-dollar facility in the state. As the Foxconn deal (and those like it) highlight, state and local governments should not create a separate standard for well-connected companies by granting them billions of dollars in special benefits or using eminent domain to seize private property to advance the needs of a single corporation.

Zeke Rogers is a Research Associate at Cause of Action Institute

Cause of Action Institute Files Lawsuit Against Commerce Department for Failing to Release Tariff Exemption Material & Information

Washington, D.C. (Oct. 18, 2018) – Cause of Action Institute (CoA Institute), a government watchdog organization, today filed a lawsuit against the U.S. Department of Commerce for failing to turn over public documents related to trade tariffs and tariff exemptions. CoA Institute first launched the investigation into the tariff exemption process after it was reported that some of the largest steel and aluminum manufacturers in the country had successfully blocked every tariff exemption filed by smaller U.S manufacturing companies.

John Vecchione, president and CEO of CoA Institute, issued the following statement:

“Tariffs manipulate the free market by creating government-controlled barriers that harm hardworking Americans and putting the economic health of our country at risk. We now have a system where the Executive Branch has the power to pick winners and losers. Our investigation seeks to uncover the process by which tariff exemptions are approved and denied, ensure the tariff-exemption exclusion process is free of political and corporate influence, and seek to uncover any communication between government officials and the companies successfully blocking tariff exemptions.”

Background and timeline:

- In March 2018, President Trump imposed a 10-percent tariff on aluminum and a 25-percent tariff on steel imports

- Trade laws allow exemptions from tariffs in the interest of national security and a recognition that some products are not readily available from U.S manufacturers

- The Commerce Department allows any company (namely, U.S. steel and aluminum companies) to file an objection to a tariff-exemption request

- The New York Times reported that every objection filed by three of the nation’s largest steel producers was successful in blocking the exemption request

- In August 2018, CoA Institute began investigating the exemption process, filing three FOIA requests (see below)

- By law, the government must respond to all FOIA requests within 20 business days

- To date, the Commerce Department has failed to respond to any of the FOIA requests relating to the tariff exemption process

Attachments:

- Complaint – Cause of Action Institute v. U.S. Department of Commerce, No. 18-2397. Tariff Exemptions

- FOIA #1 – Request for work calendars of staff and leadership at the U.S. Department of Commerce that may create or influence tariff and tariff exemption policy

- FOIA #2 – Employee records relating to tariff exemption process, guidance and employees involved in the decision-making process

- FOIA #3 – Any and all communication between staff and leadership at the U.S. Department of Commerce and companies benefiting from tariffs and those filing tariff exemptions

See also:

- The Hill: Tariff-exemption process raises serious cronyism concerns, by John Vecchione. Sept. 23, 2018.

About Cause of Action Institute

Cause of Action Institute is a 501(c)(3) non-profit working to enhance individual and economic liberty by limiting the power of the administrative state to make decisions that are contrary to freedom and prosperity by advocating for a transparent and accountable government.

Media Contact:

Matt Frendewey

matt.frendewey@causeofaction.org

202-699-2018

Bankrupt: Terry McAuliffe’s Crony Green Energy Venture Folds

There has been yet another development in the saga of GreenTech Automotive—the “green energy” car company that sought to profit from its ties to former Virginia Governor Terry McAullife, Chinese businessman Charles Wang, and Secretary Hillary Clinton’s brother, Anthony Rodham. According to papers filed in federal court last month, GreenTech and its sister corporations, including Gulf Coast Funds Management—GreenTech’s “cash-for-visas” outlet—are declaring bankruptcy.

GreenTech cites various reasons for its financial woes but emphasizes negative publicity stemming from critical reportage by the Franklin Center’s Watchdog.org, as well as investigations into possible fraud and wrongdoing by the Securities and Exchange Commission and the Department of Homeland Security Office of Inspector General. GreenTech’s bankruptcy petition recounts that the company “received investments aggregating $141.5 million from a total of approximately 283 investors,” nearly all of whom were Chinese nationals lured by the promise of permanent residency through the EB-5 Immigrant Investor Regional Center Program. (The future of the EB-5 visa program remains undecided by Congress.)

But nobody seems to know where all that money has gone, and former Governor McAuliffe and his former partners have never adequately explained its disappearance. Although GreenTech refers to “personnel issues” and “other difficulties experienced in pursing” an “ambitious business plan,” there is little evidence that much capital was ever spent on employee salaries or manufacturing, let alone research and development. As recently as May 2016, GreenTech employed only seventy-five people, never finished building a fully-operational manufacturing plant, and never sold a single vehicle.

In addition to the newly-initiated bankruptcy proceedings, GreenTech is still embroiled in several ongoing lawsuits. The State of Mississippi sued the venture last November to recover $6 million in taxpayer-funded loans and to seek forfeiture of the land provided for the never-realized car factory. GreenTech originally promised to create upwards of 25,000 jobs in the state, but later signed a pledge to invest $60 million and create 350 full-time jobs. Even those promises came to naught.

GreenTech—and Governor McAuliffe in his personal capacity— is also defending itself in a lawsuit filed by thirty-two Chinese nationals, who describe the crony venture as being part of a “$120 million scam.” Because GreenTech never created a sufficient number of qualifying jobs under the EB-5 visa program’s rules, these foreign investors face revocation of their green cards and deportation. They seek damages of at least $17.92 million. The court is now considering GreenTech’s motion to dismiss, as well as a request that proceedings be stayed pending resolution of the bankruptcy petition.

As I have previously discussed, GreenTech has been a suspicious operation from the start. It thrived only as long as it could rely on its politically-connected principals. When Cause of Action Institute released its investigative report on GreenTech in September 2013, we warned how the company’s exaggerated job-creation estimates, questionable advertising, and readiness to take advantage of favorable political connections, could violate federal law and be part of a larger scheme to defraud investors. It appears those warnings are now proving prescient.

Unfortunately, a crony venture such as GreenTech Automotive is not an outlier. For years, taxpayers have subsidized failed businesses that rely on political connections to transfer wealth to their principals, who then walk away without consequences while leaving others to pick up the pieces. It is time to get the government and the American taxpayer out of the business of picking economic winners and losers.

Ryan Mulvey is Counsel at Cause of Action Institute

Lawsuit against McAuliffe, GreenTech Automotive is long overdue

Ryan P. Mulvey: Lawsuit against McAuliffe, GreenTech Automotive is long overdue

It was always too good to be true.

Nearly ten years ago, when Terry McAuliffe teamed up with Chinese businessman Charles Wang to start GreenTech Automotive — and hired Hillary Clinton’s brother, Anthony Rodham, to sell the “green energy” car company to foreign investors — the principals made alluring promises to state officials in Virginia and Mississippi.

As expected by some — including Cause of Action Institute — even the company’s more modest promises of economic growth fell through. The writing was on the wall as early as May 2016when reports circulated that GreenTech employed only 75 people and had failed to sell a single vehicle.

Read the full column at Richmond Times-Dispatch

EB-5 “Cash-for-Visa” Investors Sue Casino Project Linked to Former Senator Harry Reid

According to the Los Angeles Times, “[s]ixty Chinese investors,” who participated in the EB-5 Immigrant Investor Program, have sued the developers and managers behind the SLS Las Vegas Hotel & Casino for failure to deliver on “promised green cards.” According to the investors’ lawsuit, the hotel redevelopment project has “not turned a profit from day one and is currently on the verge of bankruptcy.” “To make matter[s] worse,” the lawsuit continues, “the SLS Hotel[’s] revenue was less than 50% of what was projected so the project has not created sufficient jobs to allow all investors . . . to get green cards.”

The exaggeration of job-creation estimates and misleading advertising to foreign nationals is hardly unique to the SLS Casino. News of the lawsuit follows the opening of two other prominent EB-5 cases. Last week, the Securities & Exchange Commission filed a fraud lawsuit against an immigration lawyer and his firm for failing to disclose to clients that the firm was receiving substantial commissions on EB-5 transactions—“at least $1.6 million . . . from no less than six regional centers[.]” Also, in late November, The Washington Times reported that a group of thirty-two Chinese investors had filed suit against outgoing-Virginia Governor Terry McAuliffe, and his former business partners behind GreenTech Automotive, for perpetrating a “$120 million scam.” Just like the SLS Casino, GreenTech failed to create promised jobs, leaving immigrant investors to face revocation of their visas and possible deportation.

Entirely absent from the Los Angeles Times’s report, however, is the crony connection between the casino project and former U.S. Senator Harry Reid. In December 2013, CoA Institute filed a request for investigation with the Senate Select Committee on Ethics after learning that Reid contacted officials at the U.S. Citizenship and Immigration Services—including then-Director Alejandro Mayorkas—in an attempt to influence and expedite the approval of EB-5 visa applications that had been flagged for “suspicious financial activity.” The Senate Ethics Committee ignored CoA Institute’s request, claiming that it never received a copy despite evidence to the contrary. And the motivation for Reid’s intervention? His son, Rory Reid, and Rory’s law firm, Lionel, Sawyer & Collins P.C., were legal counsel to the SLS Casino, which itself was a major contributor to the Democratic Party and its candidates.

CoA Institute’s concerns about the SLS Casino and Senator Reid’s inappropriate intervention were confirmed in March 2015 when the Department of Homeland Security Inspector General released a report detailing the discomfort of career staff with the favoritism toward Senator Reid. In response, a defiant Reid dismissed agency whistleblowers who had a problem with his lobbying as a “bunch of whiners.” “If I had to do it over again, I would . . . [and] I would probably be stronger than I was,” he claimed.

Such rampant abuse and blatant politicization in the administration of the EB-5 program is one reason why CoA Institute has called for the end of the “cash-for-visa” regime all together. Too many politicians have hijacked the system to enrich themselves and others close to them. Such preferential treatment skews the marketplace and unfairly results in American taxpayers underwriting speculative business ventures that only profit so long as they have advantageous political connections.

Ryan P. Mulvey is Counsel at Cause of Action Institute

Coal Subsidies: Just As Bad As Green Energy Subsidies

Republicans promote the free market rhetorically, but in crafting policy, all too often they jump ship and support corporate subsidies for favored industries. For example: coal subsidies.

President Donald Trump followed that well-worn path last month when he called for coal subsidies that would cost American taxpayers an estimated $10.6 billion per year, according to a joint analysis from Climate Policy Initiative and Energy Innovation.

Trump appears to be trying to live up to his promise to bring back coal jobs, but he shouldn’t ignore free market principles or force the energy market at the expense of the economy as a whole. Coal has been declining in its percentage of the energy market for several decades. Although anti-coal regulations put in place by previous administrations have played a role, the increased efficiencies in the production and use of natural gas have been the primary driver of coal’s loss of market share.

Coal production started declining in the ‘80s when low-sulfur coal become harder to find. It dipped again in the late 2000s as hydraulic fracturing made natural gas cheaper to produce. Once natural gas became competitive with coal, power companies started building cheaper and more efficient gas-run generation plants.

In addition, power generation from renewable energy is estimated to increase by 169% by 2040, while coal, as a percentage of our energy mix, could decrease by 51%, Bloomberg New Energy Finance predicts. For a number of reasons, solar has even become cheaper than coal in many countries, and as the Guardian reported, even with Trump’s laudatory hands-off approach on green energy, companies are still investing heavily in alternative fuel sources.

As with all state-controlled markets, government policies that favor one sector over another end up helping certain companies and individuals at the expense of others, and ultimately, it injures consumers and the economy, generally. President Trump’s plan would subsidize only a handful of companies that operate about 90 plants in the East Coast and Midwest. Meanwhile, the specter of cronyism has emerged. As E&E News reported, the official leading the charge on this initiative previously lobbied for FirstEnergy Corp., a company that stands to benefit directly from the coal subsidies.

Trump’s plan to help the coal industry is similar to former President Obama’s initiatives to prop up green energy, which conservatives properly lambasted as inappropriately “picking winners and losers.” Indeed, President Obama funded select green energy groups that played politics well, even if they didn’t use the money as efficiently as they could. For example, Solyndra received guaranteed loans, but an investigative report showed it never got close to yielding its expected results. Its principals played politics, wasted and misused taxpayer money, and kicked the can down the road until everything collapsed. Companies like Solyndra were able to ignore the signals of the market, cash in on government largesse, funnel massive bonuses to high-salary CEOs even as their business crumbled beneath them, and were never held accountable.

If Trump uses federal coal subsidies, one should expect similar results. Coal companies will be encouraged to play politics to stay afloat instead of being encouraged to provide more efficient products and services. And this means Americans may be forced to prop up companies that aren’t able to compete in the market. It is a waste of taxpayer money.

Trump and other Republicans should embrace free market principles that incentivize competition rather than embracing a top-down approach that will help a few businesses at the expense of everyone else. By all means, eliminate the regulations that unfairly target coal at the expense of other energy sources, but don’t transfer taxpayer money in the form of subsidies, another failing business model. The government should not be in the business of picking who wins and who loses.

Tyler Arnold is a communications associate at Cause of Action Institute.