Washington D.C. – Cause of Action Institute (CoA Institute) today called upon Treasury Inspector General for Tax Administration (TIGTA) J. Russell George to investigate whether IRS employees violated the law by disclosing more than a million pages of confidential information on tax-exempt groups to the FBI and DOJ’s Public Integrity Section. CoA Institute also demanded DOJ Inspector General Michael Horowitz examine whether FBI and DOJ employees violated taxpayer confidentiality laws by inspecting that data.

CoA Institute President and CEO, and former federal judge, Alfred J. Lechner, Jr.: “The intentional disclosure of taxpayer information, especially information about groups that may have been targeted for their political viewpoints, not only violates the law but represents a breach of public trust. Americans deserve to know how Washington handles their most private information. Vigilant oversight is necessary to determine whether federal officials improperly accessed IRS records. This incident may be the largest and most significant breach of taxpayer confidentiality laws by the federal government in U.S. history.”

The call for investigation comes more than three years after CoA Institute first submitted a request for records seeking information relating to the disclosures. The IRS finally responded to the request on March 9, 2016, showing that, between 2009 and 2012, neither the FBI nor the DOJ submitted the statutorily-required requests for disclosure of sensitive tax return information. CoA Institute investigators also obtained reports submitted by the U.S. Treasury, which oversees the IRS, to the Joint Committee on Taxation of Congress, which reported only around 2,000 routine tax disclosures from IRS to the DOJ, mainly through U.S. Attorneys’ Offices. However, the IRS actually disclosed more than 1.1 million pages of tax return information to the FBI in October 2010, and the DOJ Public Integrity Section appears to have inspected that information.

To read the full letter, click HERE.

Section 6103 of the Internal Revenue Code provides a strict rule of confidentiality for tax returns and return information. Unless a statutory exception applies, government agencies and their employees may not disclose or inspect such information. Violations can include fines, termination from employment, and imprisonment.

The information in today’s letter will be incorporated into a comprehensive investigative report to be released in the coming weeks by CoA Institute. The report will outline a pattern of abuse by the Obama administration relating to the safeguarding of confidential taxpayer information.

CoA Institute Executive Director Daniel Epstein: “Our staff’s detailed review of thousands of documents over more than fifty months has confirmed the lack of compliance by this administration with statutory requirements designed to safeguard Americans’ most private information. As our forthcoming report will reveal, the administration’s revealed indifference to compliance has serious implications not only for the politicization of the bureaucracy but for the freedoms of any individual targeted by that bureaucracy’s menacing crosshairs.”

BACKGROUND

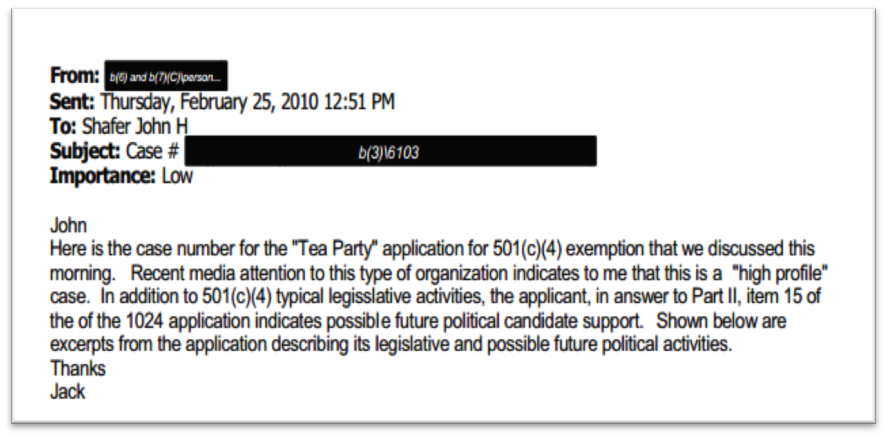

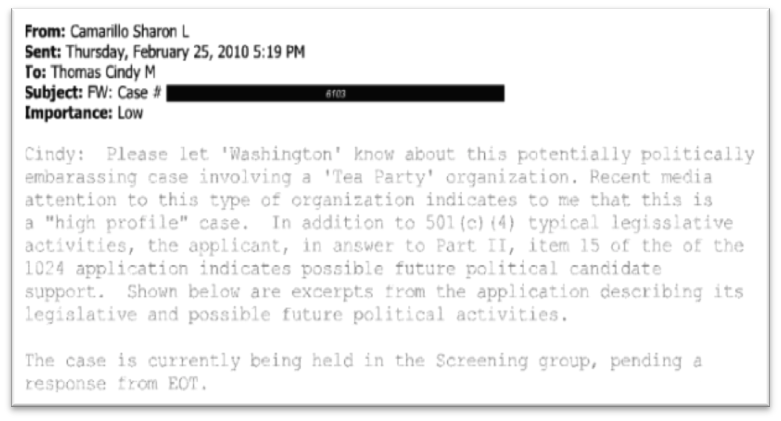

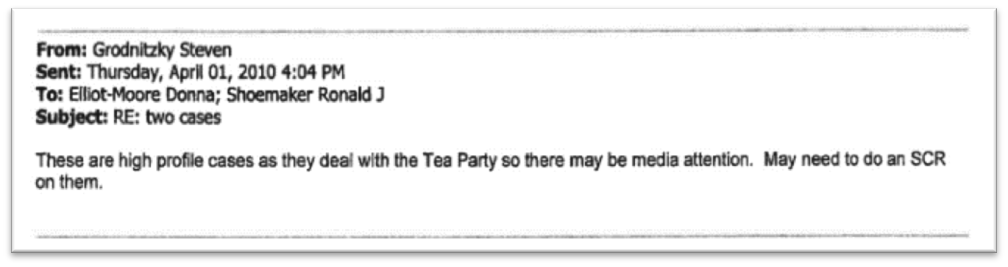

In October 2010, the IRS Exempt Organizations segment of the Tax Exempt and Government Entities Division disclosed more than 1.1 million pages of return information on 21 disks to the FBI and DOJ Public Integrity. DOJ Public Integrity and the FBI sought this information to investigate potential prohibited political activity allegedly undertaken by these groups. As part of a Freedom of Information Act lawsuit against the IRS and DOJ, CoA Institute obtained records demonstrating that neither the Public Integrity Section nor the FBI ever submitted a request for disclosure of tax return information to the IRS between 2009 and 2012, as required by federal statute.

CoA Institute alerted TIGTA about the possible violation of Section 6103 with respect to the October 2010 disclosure by letter dated July 23, 2015. But that notice went unanswered. Similar concerns raised in June 2014 by the U.S. House Committee on Oversight and Government Reform also were ignored. Now, newly-disclosed IRS records confirm these earlier concerns that the IRS, DOJ, and FBI likely broke laws prohibiting the unauthorized disclosure and inspection of taxpayer information.

As described in today’s letter, both the FBI and DOJ Public Integrity failed to file requests for disclosure under the relevant provisions of Section 6103, and the IRS lacked authorization to disclose the 1.1 million pages of tax-exempt entity return information. Given the pattern of abuse in the current Administration with respect to tax-exempt organizations, independent inquiry into what actually happened is not only appropriate, but necessary.

To access CoA Institute’s June 29, 2016 Letter to TIGTA and the DOJ IG, click here.

A full list of exhibits can be accessed here.

To access CoA Institute’s July 23, 2015 letter to TIGTA, click here.