The Department of Justice (“DOJ”) announced on Friday that it would not prosecute Lois Lerner after its two year investigation into the Internal Revenue Service (“IRS”) revealed no evidence that the IRS’s targeting of conservative group constituted criminal conduct. “Our investigation uncovered substantial evidence of mismanagement, poor judgment, and institutional inertia…[b]ut poor management is not a crime,” the DOJ wrote in a letter to Congress.

The DOJ investigation echoes congressional reports, which broadly attributed “poor judgment” as the reason that so many Tea Party groups experienced delay and unequal treatment by the IRS. Even the President, after initially expressing outrage, ultimately blamed “bonehead decisions out of a local office,” stating that the IRS employees were just implementing the law “poorly and stupidly.”

The DOJ’s decision not to prosecute comes as no surprise to Cause of Action, which has been investigating the IRS and its operating procedures for more than two years. Our investigation, which was documented earlier this year in National Review, shows that the targeting of conservative groups was not caused by IRS employees making “bonehead decisions,” but, rather, was the direct result of employees actually following IRS procedures perfectly- not “poorly.” And certainly not “stupidly.”

The Internal Revenue Manual (“IRM”), the employee handbook that sets all IRS processes, required agents to apply extra scrutiny to Tea Party applications. The IRM requires that an application from an organization that is “newsworthy” be elevated up to management for review. It also requires that IRS employees create a Sensitive Case Report for an application that is of interest to the media. These processes subject applications to extra levels of review, delays in processing, and allow high-ranking IRS officials to make the final say in whether to approve or deny the application for tax-exempt status.

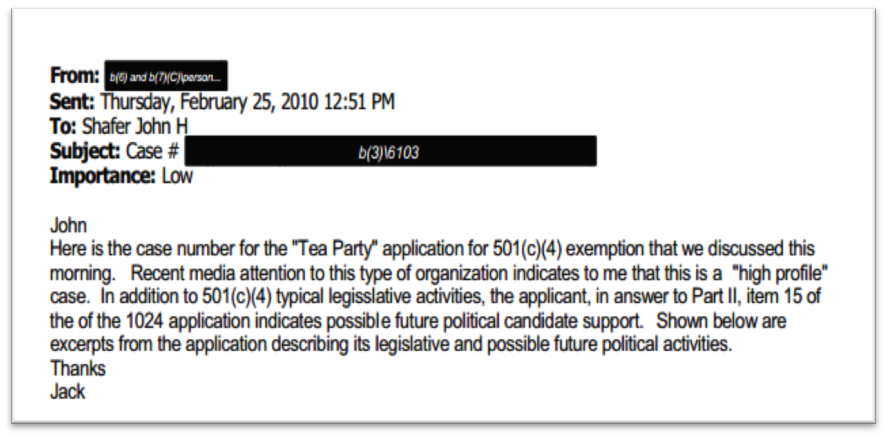

This is exactly what happened to Tea Party applications. In 2010, all major media outlets covered the Tea Party movement. When an IRS employee in Cincinnati received the first Tea Party application, he immediately elevated the issue to his supervisor due to “recent media attention.”

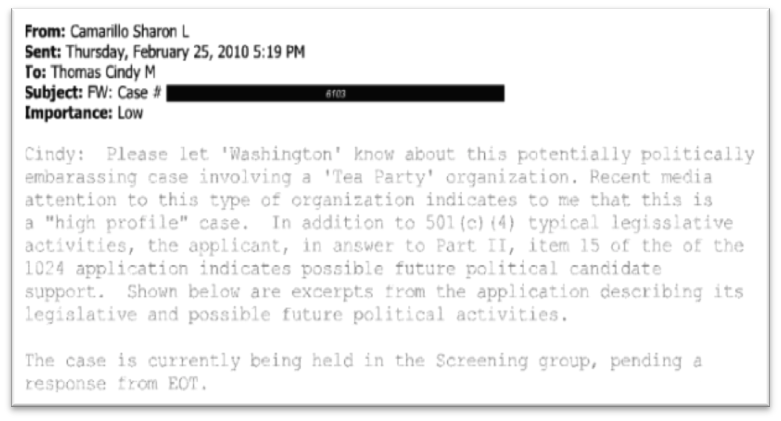

In turn, this manager notified Cindy Thomas, head of the entire Cincinnati office, to elevate it to the national office to “let Washington know about this potentially politically embarrassing case involving ‘Tea Party’ organization.”

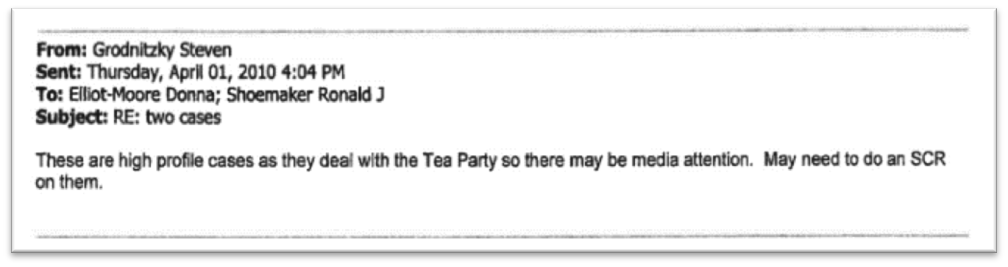

On April 5, 2010, IRS employee Steve Grodnitzky directed subordinates to prepare a Sensitive Case Report for the Tea Party cases due to this media attention.

Ultimately, Lois Lerner first learned about the Tea Party applications when she received a Sensitive Case Report summary listing these applications.

In the end, while the investigation into Lois Lerner was well intentioned, her prosecution would not have prevented political targeting from happening again in the future. In order to truly solve the problem, the IRS must reform its internal policies. The fact that an organization receives media coverage should never result in delays or unequal scrutiny.