By Charles S. Clark

July 30, 2013

Two conservative groups with long-standing tax-exempt status were unfairly targeted by the Internal Revenue Service and merit a new investigation by the inspector general, according to two members of the sharply divided House Oversight and Government Reform Committee.

Reps. Darrell Issa, R-Calif., chairman of the panel, and Jim Jordan, R-Ohio — acting without cooperation from the panel’s ranking member Elijah Cummings, D-Md. — on Monday wrote a letter complaining about audits and unfair paperwork demands that a controversial unit of the tax agency imposed on the Arlington, Va.-based Leadership Institute and the Herndon, Va.-based Claire Boothe Luce Policy Institute.

“The totality of your ‘targeting’ investigation along with evidence obtained by the committee points to the fact that the IRS may have selected certain conservative organizations for additional scrutiny after the IRS already approved their tax-exempt status,” Issa and Jordan said in a letter to J. Russell George, the Treasury inspector general for tax administration.

The Leadership Institute, founded in 1970 and run by longtime conservative activist Morton Blackwell, reported about $15 million in assets in 2012. During IRS audits, the lawmakers’ letter said, the group had to turn over 23,430 pages of documents at a cost of some $50,000. Staff told congressional investigators that they were asked “invasive questions, including requests for information about its interns and where they worked after their internships.”

The Clare Booth Luce Policy Institute, founded in 1993 to advance conservative women and run by Michelle Easton, an Education Department appointee during the Reagan and George H. W. Bush administrations, reported assets of some $2 million. Easton told congressional staff that its treatment by the IRS amounted to “harassment,” and that its audit “took the greater part of 2011 and cost tens of thousands of dollars.”

Both have 501(c)3 nonprofit status.

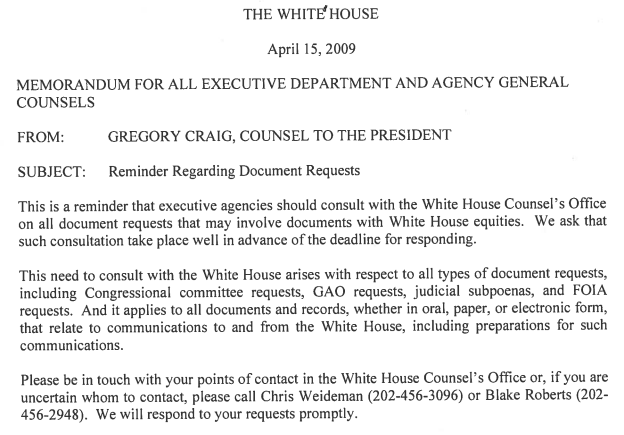

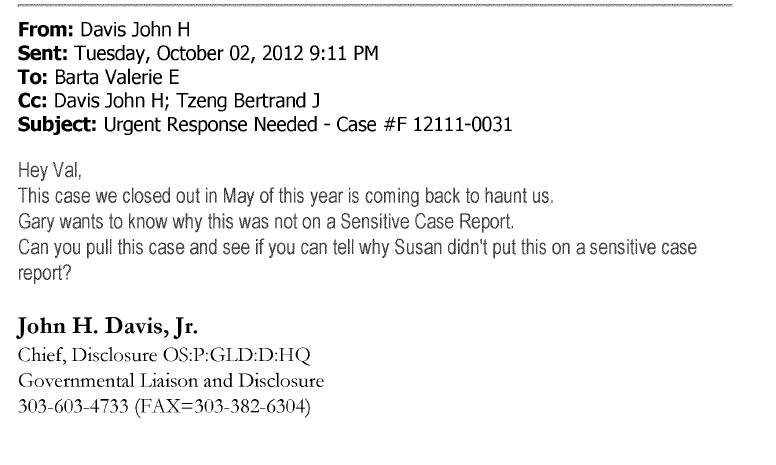

The Republican lawmakers want auditors to determine whether the Cincinnati-based entity within the IRS’ Exempt Organization Division called the Review of Operations Unit had been flagging groups with longtime tax-exempt status in addition to the 300-400 groups that had applied for the status beginning in 2010 that became the subject of this spring’s IRS scandal. Issa quoted an email from Lois Lerner, the director of Exempt Organizations who is on administrative leave and who so far has declined to testify to Issa’s panel, instructed underlings that “[o]ne of the recommended actions is going to be to send ROO referrals for those cases that cause us concern resulting from organizations making changes after being questioned during our case development.”

The request on Tuesday drew a rebuke from Cummings, who in a letter to Issa, said, “your letter appears to provide partial and incomplete information and to disregard key evidence that is contrary to your political narrative.”

Quoting from transcripts of congressional staff interviews with IRS employees who processed the nonprofits’ applications, Cummings said Issa’s version fails to explain that the head of the Exempt Organizations Determinations Unit in Cincinnati told the committee that referrals to the ROO were not “systematic,” but instead were done on a case- by-case basis. Also left out of the request to TIGTA, Cummings added, was the testimony from another employee saying that a referral to the ROO did not automatically result in an audit of the organization.

“The committee,” Cummings concluded, “has identified no evidence that the IRS discriminated against conservative groups that had been approved for tax exempt status.”

In another sign that the political and legal maneuvering stemming from the IRS scandal are not fading away, a transparency advocacy group called Cause of Action on Monday announced that it has hit the IRS’ Exempt Organizations Division with a complaint about Enroll America, a nonprofit that is also a 501(c)3 that works on a parallel track with the Health and Human Services Department to promote enrollment in health insurance exchanges during implementation of the Affordable Care Act.

Cause of Action is seeking removal of Enroll America’s charitable status because it operates “like a business league or trade association,” providing a profit incentive and performing marketing and lobbying for medical and insurance interests rather than charitable acts. “If Enroll America is designed to benefit insurance companies instead of the American public, then its charitable status no longer applies,” argued Dan Epstein, Cause of Action’s executive director. “An organization that has been granted tax deductible status but is actually depriving the American people of taxable revenue warrants an investigation.”

To read the full article, click here.