In his State of the Union address last month, President Donald J. Trump patted himself on the back for the economic boom and the steady drop in unemployment over the past year. Many economists agree that he ought to take some credit, and suggest his deregulatory push has played a role. To discuss the Trump administration’s regulatory achievements, Neomi Rao, the president’s appointee for administrator of the Office of Information and Regulatory Affairs (“OIRA”) last week joined the Federalist Society’s Free Lunch Podcast.

Last year was “a banner year for regulatory reform,” Rao said in the beginning of the podcast.

When Trump took office, he signed Executive Order 13771, ordering agencies to eliminate two regulations for every new regulation added. It also capped the net cost of new regulations to zero dollars. This means that for every new dollar in regulatory costs, one offsetting dollar had to be cut from regulatory costs elsewhere.

Rao said that the administration lived up to Trump’s campaign promise – and then some. For every new regulation added, 22 regulatory actions were cut, which she said far exceeded his promise. Additionally, the net savings for Americans on regulations was $8 billion, also exceeding his promise. The administration also halted 1500 new rules proposed under the previous administration because, Rao said, it wants to analyze the scope and content of all regulations.

But more important than these small changes, according to Rao, the administration is striving to make structural and cultural reform, which would hopefully extend into future administrations. “We want to continue with the momentum from the past year and with the success that we had,” she said.

For example, Rao indicated that agencies must properly follow the Congressional Review Act (“CRA”), which Rao claims requires them to submit proposed regulations to OIRA, so it can determine whether it imposes a cost of $100 million or more. If it does, then OIRA sends the proposed regulation to Congress for approval. Agencies that don’t comply, she said, risk some of their rules losing legitimacy.

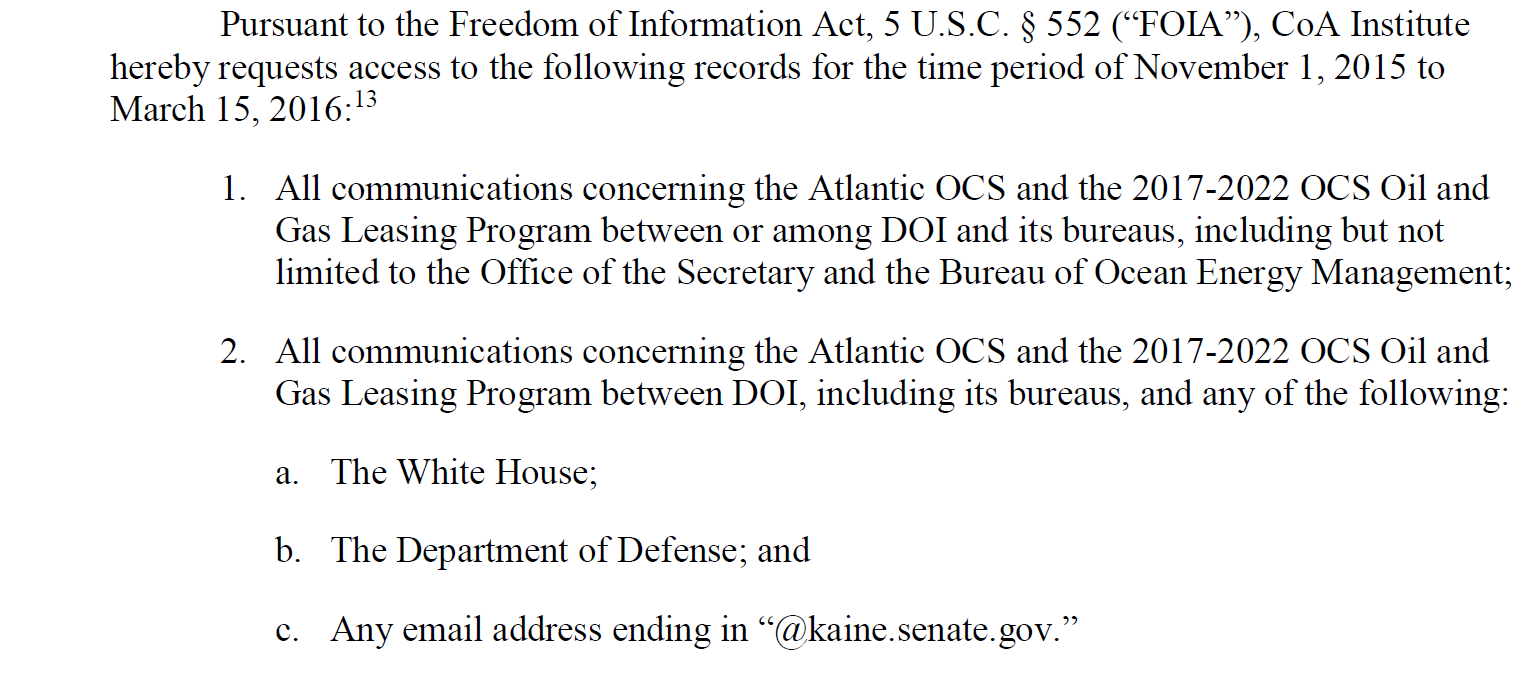

As Cause of Action Institute has pointed out over the past year, there are hundreds of rules that are currently vulnerable to be repealed under the CRA that have yet to be received by Congress. For example, last month Cause of Action Institute released an investigative report revealing the IRS has dodged compliance with the CRA and other oversight mechanisms by suggesting that its rules have no economic impact, a suggestion that we have argued is false and intended to shield the agency’s actions from oversight.

Apart from the economic effect of excess regulations, Rao said OIRA is working to make sure the government is more respectful of the separation of powers and more transparent. Because only Congress has the power to make laws, Rao said it can be dangerous to increase the power of the executive branch to the extent that it is making a lot of rule changes. To improve transparency, OIRA will ensure that agencies comply with a federal law that requires they give public notices of new rules and regulations so that the public and stakeholders have an opportunity to voice their support or opposition. Additionally, Rao said OIRA will be working to reduce paperwork for businesses to save them cost and time.

The Trump administration has made progress in the past year to cut regulatory red tape. Hopefully the administration can continue going in this direction with a series of structural changes to scale back the administrative state.

Tyler Arnold is a communications associate at Cause of Action Institute.