Whether we like it or not, the Internal Revenue Service (IRS) plays a central role in the administration of our tax laws. The agency consequently possesses copious amounts of sensitive financial information about individual Americans, nonprofits, and other corporations. Congress considered the protection of such information so important that it has mandated its confidentiality. Section 6103 of the Internal Revenue Code requires that “returns and return information”—essentially, anything about a taxpayer in IRS files—“shall remain confidential.” The importance of taxpayer confidentiality, and the danger inherent in its unauthorized disclosure, is one reason why the 2010 “Tea Party” targeting scandal was so serious—the Obama White House weaponized the IRS to target individuals and nonprofit groups based on their perceived political alignment.

IRS records recently produced to Cause of Action Institute (CoA Institute) in a Freedom of Information Act (FOIA) lawsuit now shed further light on how carelessly the IRS and the Department of Justice (DOJ) handled sensitive taxpayer information and only belatedly admitted to Congress that they had violated taxpayer confidentiality. In 2012, CoA Institute began its in-depth investigation into the nature and causes of the IRS targeting scandal and the misdeeds of government bureaucrats such as Lois Lerner. Part of our investigation revealed that IRS officials, including Ms. Lerner, willingly handed over twenty-one computer disks, containing over 1.1 million pages of taxpayer information, to the DOJ Public Integrity Section and the Federal Bureau of Investigation (FBI), despite lacking proper legal authorization to do so. This allegedly was done as part of the previous Administration’s efforts to investigate exempt entities suspected of having engaged in prohibited political activity.

After repeatedly insisting that it had received only “publicly available portions” of Form 990s when the IRS turned over those 1.1 million pages of taxpayer information, the DOJ later admitted it was mistaken. The records received by CoA Institute confirm that was the case.

In two requests for investigation (here and here), CoA Institute explained why the IRS’s unauthorized disclosure constituted a serious breach of taxpayer confidentiality laws. But the DOJ Inspector General, while admitting that taxpayer data had been mishandled, choose to do nothing and merely stated that Congress had been “informed” and “this matter does not warrant further investigation.” The DOJ watchdog’s inaction led to a series of further FOIA requests (here, here, and here) that were designed to discover more about what the IRS and DOJ had done, and how Congress was alerted to the violation of Section 6103. CoA Institute obtained the requested records only after filing a lawsuit to compel disclosure.

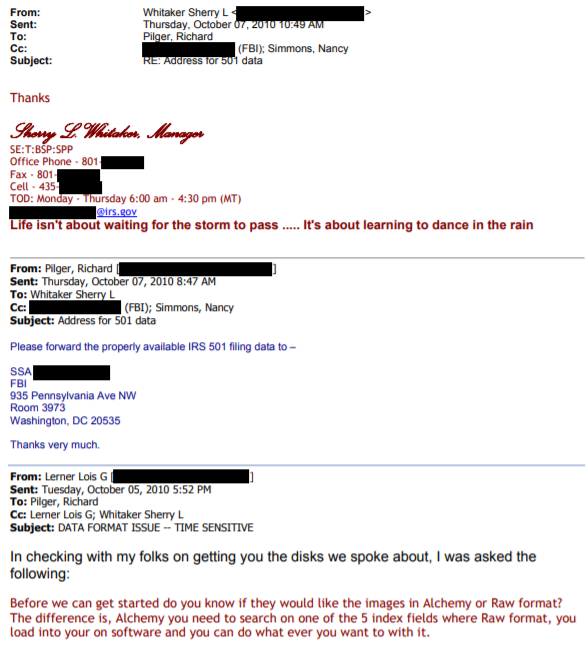

Section 6103 sets out clear rules for the handling of tax information. Those rules are in place to protect taxpayer privacy. In this case, however, the rules were not followed. The DOJ never had proper authorization to obtain the nonprofits’ tax information, including information about donors. But the IRS nevertheless transferred 1.1 million pages of returns to the DOJ and agreed to provide the data in “raw” format, so that it would be easier for the FBI to process.

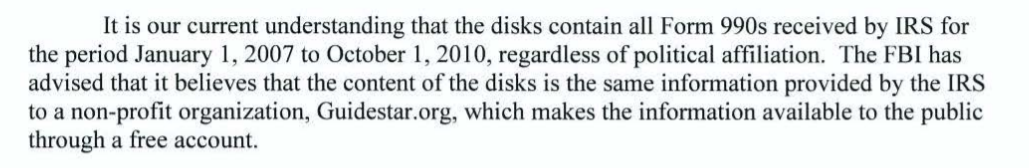

On May 29, 2014, after the U.S. House of Representatives Committee on Oversight and Government Reform opened an investigation into the unauthorized transfer of these tax returns, the DOJ claimed that it had obtained only publicly available information, such as the returns available online on Guidestar.org.

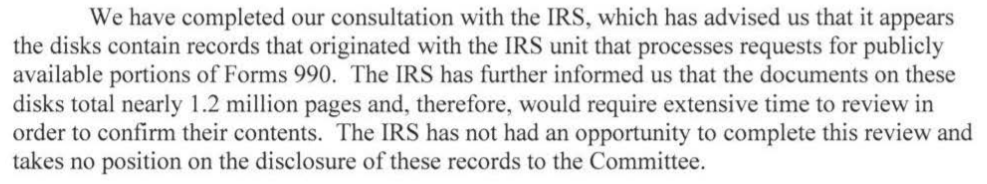

Days later, on June 2, 2014, the DOJ again argued that the trove of tax information it obtained from the IRS was not confidential.

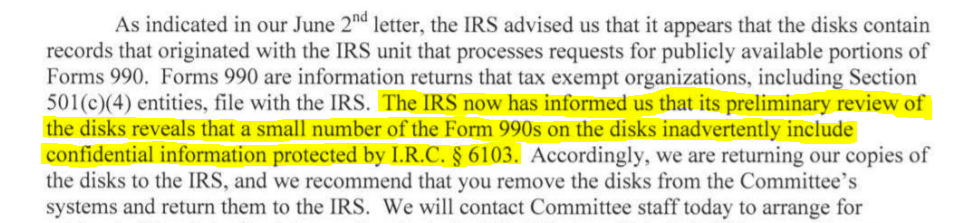

And then, only two days after that, the DOJ changed its story—the agency admitted that the IRS had discovered confidential Section 6103 information within the 1.1 million pages of returns and return information. The DOJ claimed that the disclosure had been “inadvertent,” and it indicated that it was “returning [its] copies of the disks to the IRS[.]” Unfortunately, it is impossible to judge just how serious this “inadvertent” breach of confidentiality was because the DOJ has refused to furnish the House Oversight Committee with internal correspondence about the incident. It has withheld this correspondence by citing the deliberative process privilege—a species of executive privilege— and, to date, those records remain secret.

To be clear, by returning the twenty-one CDs to the IRS and informing Congress about what happened, the DOJ followed proper procedure. But that does not exonerate the federal government for having allowed the breach of taxpayer confidentiality to have happened in the first place. All citizens deserve to know their government does not act with political motivations, and that the IRS will safeguard sensitive taxpayer information, especially as it pertains to charitable giving and the operation of nonprofit entities.

The DOJ’s delayed disclosure of records, which finally give a complete picture of what happened, also illustrates another danger of politicization, namely, of the FOIA process. In this case, the DOJ put up so many hurdles to accessing these records that it required a lawsuit to compel disclosure. Even then, it took months for the agency to produce the records. It would have been next to impossible for an ordinary citizen to get the same result.

For government to be truly transparent, it must be held accountable by its citizens. The behavior of the IRS and DOJ in this case is a perfect illustration of why CoA Institute is committed to fighting for an open and transparent government. Government agencies should not be allowed to violate statutes and then stonewall requests that seek to expose the truth. That is why we pursued this investigation and why we will continue to vigorously serve as a government watchdog on behalf of every American.

Ryan Mulvey is Counsel at Cause of Action Institute.