This memorandum addresses some of the legal and political issues raised by the Internal Revenue Service’s (IRS) records retention policy and practices in relation to the lost emails of Lois Lerner, former Director of the IRS’s Exemption Organizations unit.

Dan Epstein on the Peter Schiff Show 6/25/2014

Cause of Action’s Dan Epstein talks with Peter Schiff about the IRS targeting scandal.

FOIA Follies: Here’s What Qualifies for a (b)(5) Redaction at the IRS

In October 2012, Cause of Action submitted a FOIA request to the Internal Revenue Service (IRS) seeking records related to any requests from the President for individual or business tax returns. In response to our request, the IRS released 790 pages of records but redacted a substantial amount of information pursuant to Exemption 5 of the FOIA. Exemption 5 protects “inter-agency or intra-agency memorandums or letters which would not be available by law to a party other than an agency in litigation with the agency.” Nate Jones of the National Security Archive recently called it the “withhold it because you want to” exemption. It is often triggered to protect the “deliberative process” among government employees, but DOJ guidance from 2009 notes that, “records covered by the deliberative process privilege in particular have significant release potential.”

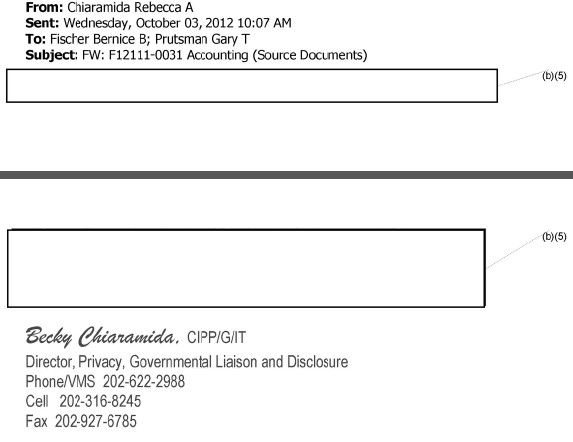

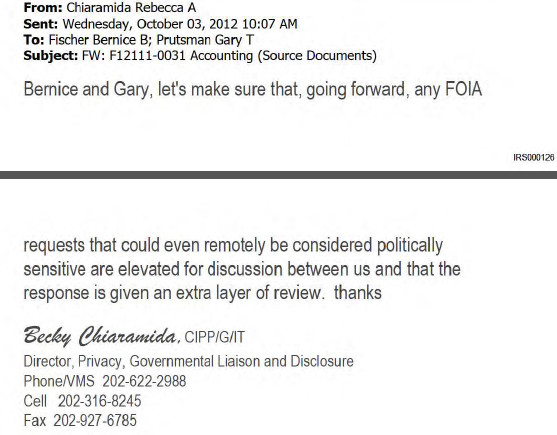

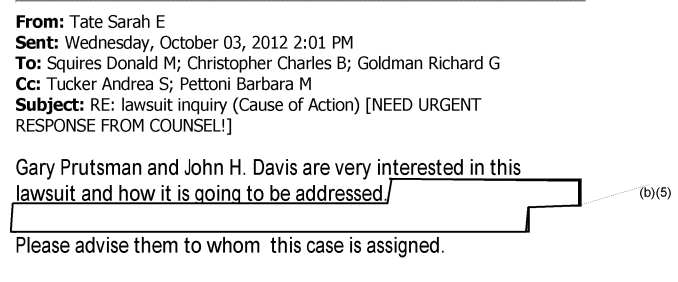

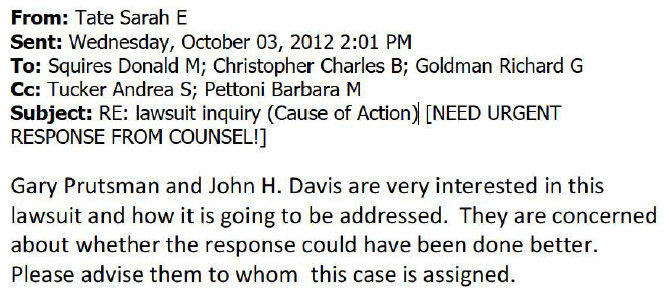

Cause of Action decided to challenge the IRS’s application of Exemption 5. We filed and an appeal that the IRS denied, and then filed a lawsuit on June 19, 2013. In its response to our lawsuit, the IRS “reconsidered some of the redactions made to the 790 pages.” The resulting changes show how broadly IRS applied Exemption 5 to redact parts of certain emails. Here’s a sample of what the IRS redacted pursuant to the exemption (see the documents here):

“Bernice and Gary, let’s make sure that, going forward, any FOIA requests that could even remotely be considered politically sensitive are elevated for discussion between us and that the response is given an extra layer of review. thanks”

Original Release

Unredacted

“They are concerned about whether the response could have been done better.”

Original Release

Unredacted

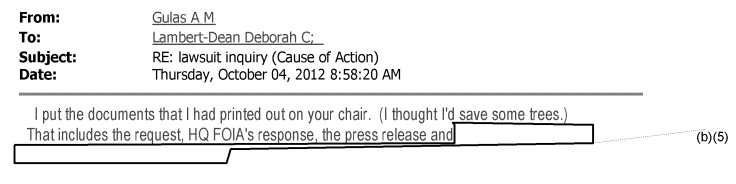

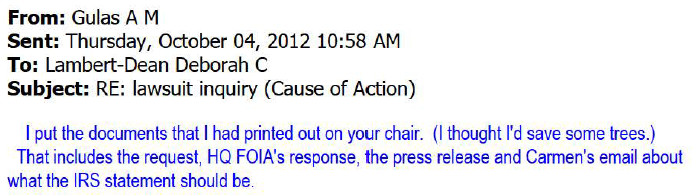

“Carmen’s email about what the IRS statement could be.”

Original Release

Unredacted

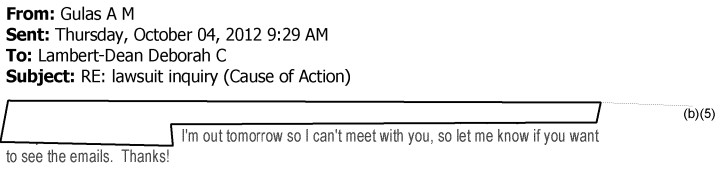

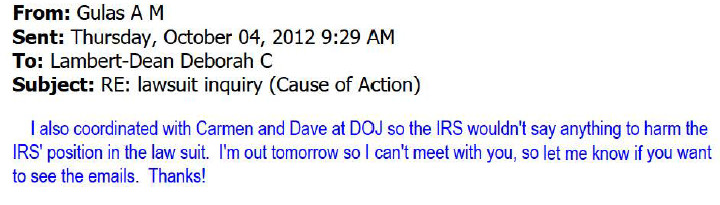

“I also coordinated with Carmen and Dave at DOJ so the IRS wouldn’t say anything to harm the IRS’ position in the law suit.”

Original Release

Unredacted

“Media Relations is attempting to refute allegations we are improperly hiding behind privacy laws.”

Original Release

Unredacted

“However, now that we’ve got the litigation threat, we have to determine if we were okay not to disclose the mere fact of WHETHER the president made any such requests at all, thereby disclosing the fact that either the documents did, or did not exist.”

Original Release

Unredacted

President Obama’s 2009 memo on FOIA declared, “In the face of doubt, openness prevails.” Attorney General Holder wrote, “[A]n agency should not withhold information simply because it may do so legally.” Despite these pledges, agencies are still choosing to hide information from the public. As these emails show, the IRS is abusing Exemption 5 to “withhold it because they want to.” Promises of transparency have not created more openness in government. Significant reform is needed to limit the abuse of FOIA exemptions so that citizens, journalists, and watchdog groups can continue to fight for accountability in the government.

FOIA Request to IRS regarding IRS Targeting and Records Management

Yesterday Cause of Action, along with Tea Party Patriots, sent a Freedom of Information Act request to the IRS seeking to discover who was responsible for the targeting of conservative groups and to determine how the IRS maintains records in (or not in) accordance with federal law.

On January 26, 2009, in one of President Obama’s first acts in office, the President issued an executive order to allow both incumbent and former Presidents to claim executive privilege on certain records they sought to protect. Three years later, on August 24, 2012, the White House issued a Directive that “require[d] that to the fullest extent possible, agencies eliminate paper and use electronic recordkeeping. It is applicable to all executive agencies and to all records, without regard to security classification or any other restriction.” It is entirely possible that the IRS followed this Directive in a manner that violated the Federal Records Act.

“Because the White House may consult the Archivist of the United States and dispose of certain records, the White House’s inability to locate any emails from Lois Lerner during the time frame of her ‘lost’ emails doesn’t prove that no emails existed at one time. The IRS follows different records preservation laws than the President. That is why access to these records are critical to determining who was responsible for targeting conservative groups,” said Cause of Action’s Executive Director Dan Epstein. “Accountability is unfortunately an uphill climb with this agency, but it is necessary to determine who, both within and without the IRS, is responsible for the political targeting that occurred against certain nonprofit groups. That is why we are seeking information on what and how the IRS retains in terms of data, emails, investigations, and protocol.”

06-23-2014 IRS FOIA Request Re Missing Lerner Emails by Cause of Action

Bloomberg BNA: Groups Push Obama Executive Order To Halt IRS Proposed Section 501(c)(4) Rules

An excerpt from a May 2, 2014 Bloomberg BNA story:

Cause of Action, a conservative government accountability group, is asking the Office of Information and Regulatory Affairs to force the Internal Revenue Service to declare that its proposed rule on limiting the political activities of Section 501(c)(4) organizations is “a significant regulatory action” under an executive order signed by President Barack Obama.

Executive Order 13563, signed by Obama in January 2011, says that in deciding whether and how to regulate, federal agencies should assess all costs and benefits of available regulatory alternatives–including the alternative of not regulating. The order affirms and builds on Executive Order 12866 signed by former President Bill Clinton in 1993 .

Cause of Action said the Office of Management and Budget is attempting to “game the system” by saying the executive orders don’t apply to the 501(c)(4) rules.

Daily Caller: COMPLAINT: IRS ‘improperly withheld’ documents on new nonprofit rules

Read the full story: Daily Caller

The group Cause of Action requested four sets of communications between the IRS and administration officials to ensure that political bias did not factor into the design of the new rules. But the IRS delayed the release of the documents until after the period to make public comments on the new rules closes Thursday, according to an amendment to Cause of Action’s existing lawsuit against the IRS.

“By letter dated January 30, 2014, the IRS informed Cause of Action that its FOIA request had been received… However, the IRS advised that it would be unable to complete the processing of the request even by February 13, 2014. Instead, the IRS estimated that its final response would not be forthcoming until May 16, 2014,” according to the complaint.