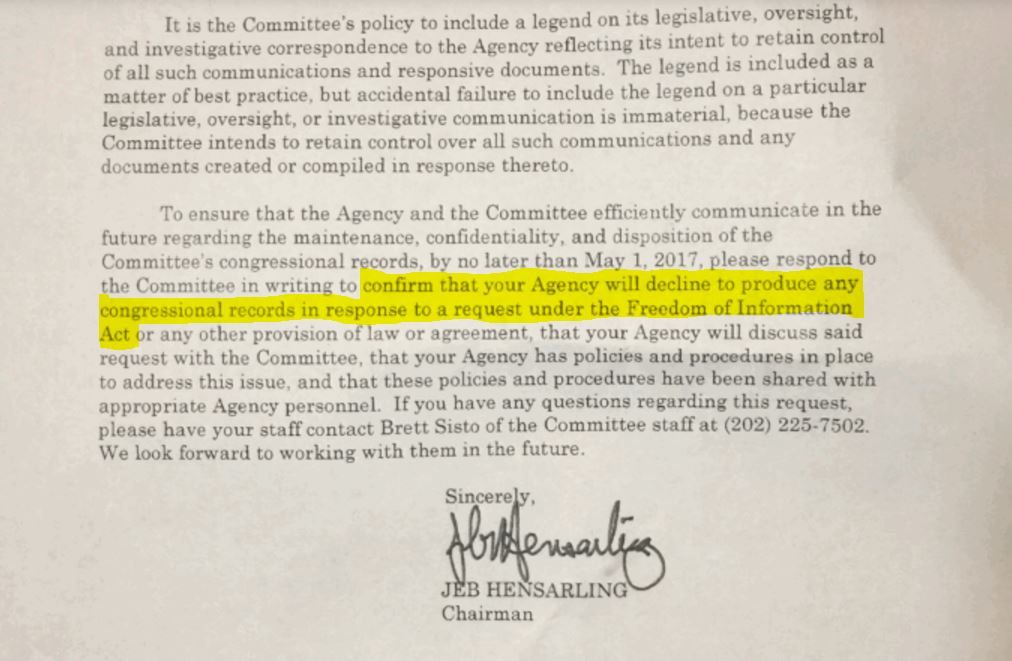

Cause of Action Institute (“CoA Institute”) filed a Freedom of Information Act (“FOIA”) request with the Department of Justice (“DOJ”) today in response to recent reports that Representative Jeb Hensarling, Chairman of the House Committee on Financial Services, directed the Department of the Treasury and at least eleven other agencies to treat all records exchanged with the Committee as “congressional records” not subject to the FOIA.

CoA Institute’s request is narrowly tailored to uncover records that could reveal whether the DOJ’s Office of Information Policy—which oversees government-wide compliance with and policy concerning the FOIA—and Office of Legislative Affairs were consulted by Chairman Hensarling, or others, prior to the release of the controversial FOIA directive. The request also seeks records concerning possible White House involvement and whether agencies sought the DOJ’s advice before responding to Chairman Hensarling.

Federal law requires that Congress manifest clear intent to maintain control over specific records to keep them out of reach of the FOIA. Chairman Hensarling’s directive is ineffective, in that regard. As I have argued elsewhere, the mere fact that an agency possesses a record that relates to Congress, was created by Congress, or was transmitted to Congress, does not, by itself, render it a “congressional record.” And, as set forth in a coalition letter joined by CoA Institute, ignoring this well-established standard would “improperly restrict the ability of the public to use FOIA” and impede transparency and good government.

Ryan Mulvey is Counsel at Cause of Action Institute