Washington, D.C. – Cause of Action Institute (“CoA Institute”) today led a coalition of 17 organizations in sending a letter to President Trump and senior administration officials urging them to hold the IRS accountable by working to end the agency’s practice of dodging oversight of its rules.

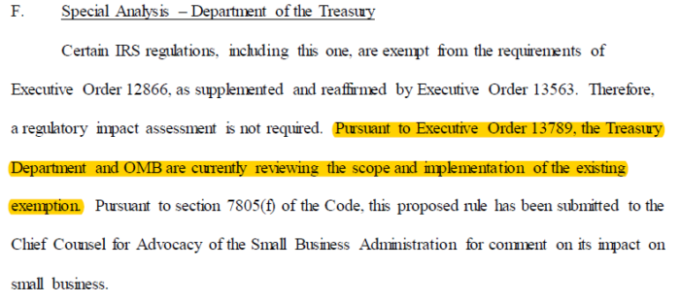

CoA Institute recently issued an investigative report titled Evading Oversight: The Origins and Implications of the IRS Claim That Its Rules Do Not Have an Economic Impact, detailing how the IRS created and expanded a series of self-bestowed exemptions from three important regulatory oversight mechanisms. The IRS created these exemptions by claiming that the economic effects of its rules flow from the underlying statute and not its regulatory choices.

The letter states:

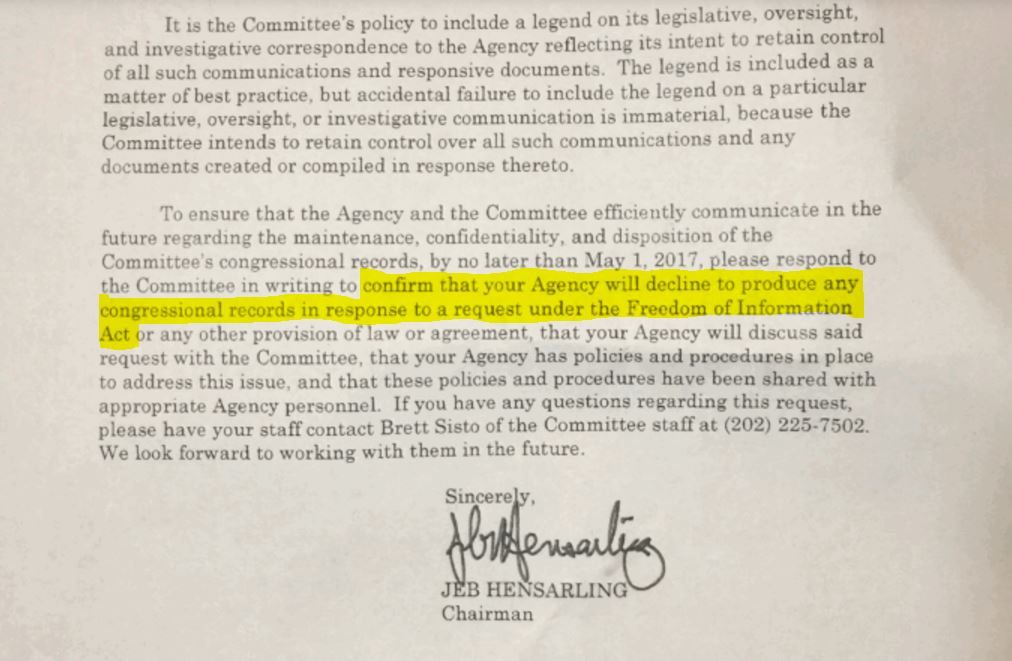

This IRS practice denies Congress information about IRS major rules that should be reported to the Government Accountability Office under the Congressional Review Act. It also hinders the White House’s ability to fulfill its constitutional obligation to supervise the Executive Branch by conducting oversight of IRS regulations pursuant to Executive Order 12,866. And it impacts the public’s right to learn about and comment on the economic impact of the IRS rules that are subject to the Regulatory Flexibility Act… The IRS should live by the same rules of administrative law and agency oversight as the rest of the Executive Branch.

The letter was sent to President Trump, Secretary of the Treasury Steven Mnuchin, Office of Management and Budget (“OMB”) Director Mick Mulvaney, and Office of Information and Regulatory Affairs (“OIRA”) Administrator Neomi Rao.

The letter urges the Department of the Treasury and OMB to withdraw from a decades-old agreement allowing the IRS to avoid White House review of its rulemakings. Last week, two former heads of OIRA, Susan E. Dudley who served under President George W. Bush and Sally Katzen who served in the Clinton administration, wrote in The Wall Street Journal that this longstanding agreement has been abused and agreed it should be reconsidered.

Further, the coalition letter firmly holds that the IRS should not be permitted to claim that the economic impact of its rules is due to the underlying statute and not its regulatory choices.

The full letter can be found here.

The following groups signed:

American Business Defense Council

Dick Patten, President

American Commitment

Phil Kerpen, President

Americans for Prosperity

Brent Wm. Gardner, Chief Government Affairs Officer

Americans for Tax Reform

Grover Norquist, President

Association of Mature American Citizens

Dan Weber, President & CEO

Campaign for Liberty

Norm Singleton, President

The Carlstrom Group

Bob Carlstrom, President

Cause of Action Institute

John Vecchione, President & CEO

Center for Freedom and Prosperity

Andrew F. Quinlan, President

Council for Citizens Against Government Waste

Tom Schatz, President

Family Business Coalition

Palmer Schoening, Chairman

Freedom Partners Chamber of Commerce

Nathan Nascimento, Executive Vice President

FreedomWorks

Jason Pye, Vice President of Legislative Affairs

Hispanic Leadership Fund

Mario H. Lopez, President

National Taxpayers Union

Pete Sepp, President

Taxpayers Protection Alliance

David Williams, President

Tea Party Patriots

Jenny Beth Martin, President

For information regarding this press release, please contact Zachary Kurz, Director of Communications at CoA Institute: zachary.kurz@causeofaction.org.