Records obtained by Cause of Action Institute (“CoA Institute”) through the Freedom of Information Act (“FOIA”) reveal that Ambassador Robert Lighthizer, the United States Trade Representative (“USTR”), and Stephen Vaughn, General Counsel to the USTR and former Acting Trade Representative, used their personal email addresses to conduct official government business in 2017 and 2018. Considering the Administration’s aggressive trade policy that is increasing costs on American consumers and businesses, transparency is of paramount importance.

The Brief – June 3, 2019

Cause of Action Institute published its May newsletter today. You can read the newsletter here and subscribe to our monthly newsletter here.

Message from John

Our team is fortunate enough to spend every day working to tear down barriers and protect individual and economic liberty, and we are exceptionally grateful for the days where we get to see those barriers removed. In early May, Cause of Action celebrated a decision from a U.S. District Court denying all damages against our clients, Robert and Angelo Cupo, and their small business. This decision was not only a victory for this family, but for all small business owners and entrepreneurs who fear the administrative state.

GAO Report Finds EXIM Potentially Provides Billions in Financing to Companies with Delinquent Federal Debt

While the Export-Import Bank (EXIM) celebrated the recent confirmation of its president and two members of its board of directors, the Government Accountability Office (GAO) released a troubling report concerning EXIM potentially providing billions of dollars in loans and financing to companies improperly. GAO found EXIM failed to use a federal database available to all government agencies free of charge to identify companies that have delinquent federal debt. Consequently, EXIM may have provided financing to ineligible companies and increased it’s susceptibility to fraud.

Investigation Update: GSA Continues to Block Disclosure of White House Directive on Congressional Oversight Requests, Reveals Sensitive Review Procedure for Media Requesters

Cause of Action Institute (CoA Institute) received an interim response yesterday from the General Services Administration (GSA) on a Freedom of Information Act (FOIA) request that suggests the agency is deliberately stonewalling the release of a White House directive instructing agencies on how to respond to congressional oversight requests. Records released by the agency also suggest that the GSA has implemented a “sensitive review” FOIA process by which news media requesters are subject to an extra layer of pre-production review.

Cause of Action Institute Calls on NASA to Revise Proposed FOIA Rule

Cause of Action Institute (CoA Institute) submitted a public comment to the National Aeronautics and Space Administration (NASA) today, concerning the agency’s proposed revisions to its Freedom of Information Act (FOIA) regulations. Our comment offers improvements to various aspects of the proposed rule which are inconsistent with current statutory guidelines regarding fee reduction classifications and the proper scope of searches for relevant records. CoA Institute also suggests an additional provision that was not proposed by the agency, implementation of the “foreseeable harm” standard, a provision we are investigating government-wide.

NASA refers to the White House Office of Management and Budget’s Uniform FOIA Fee Schedule and Guidelines as an authority for interpreting the FOIA and the agency’s implementing regulations. However, the OMB Guidelines have been statutorily superseded, in part, by Congress’s passage of the OPEN Government Act of 2007 and conflict with case law developments. CoA Institute asks NASA to remove any reference to the OMB Guidelines in its final rule. This change is important because continued reliance on the OMB Guidelines will make it more difficult for certain kinds of requesters to receive fee reductions. Specifically, the OMB Guidelines retain outdated definitions of “representative of the news media”[1] and “educational and non-commercial scientific institution.”[2] This change will also make NASA’s regulations internally consistent, as they often correspond with current law and, consequently, contradict the outdated guidelines.

Although NASA adopts the current definition of a “representative of the news media,” it seeks to impose novel requirements that would make it more difficult for news media requesters to obtain a fee reduction. Specifically, NASA would require a news media requester to explain (1) how it intends to disseminate records, (2) why those records constitute “current news,” or are of “public interest,” and (3) how the records will “shed light on agency statutory operations.” Each of these requirements is inconsistent with the FOIA and relevant caselaw, particularly Cause of Action v. Federal Trade Commission. The fee category inquiry turns on the nature of the requester, not the purpose of his or her request. If NASA retains these proposed hurdles, journalists and watchdogs, among others, will find it more difficult to receive favorable fee treatment.

Additionally, certain language in the proposed rule suggests that NASA considers only records within its physical “possession” to be subject to the FOIA. This misstates the law. Whether a record is an “agency record” for purposes of the FOIA, and therefore available for disclosure, depends on whether it is under an agency’s legal “control.” “Control” includes instances of “constructive possession,” such as when records are stored in private email accounts or created and/or maintained by a contractor. The FOIA statute and relevant case law are clear on this point. If NASA does not replace the word “possession” with “control” it will engender confusion and may lead to the improper denial of FOIA requests, particularly those that seek records of agency business that were created or obtained on personal accounts or record systems.

NASA’s rulemaking is supposed to implement the FOIA Improvement Act of 2016, but there is one amendment that has not been addressed: the “foreseeable harm” standard. Under that new standard, an agency may only withhold records if it “reasonably foresees that disclosure would harm an interest protected by an exemption” or “disclosure is prohibited by law.” The rule prohibits the mere technical application of FOIA exemptions. Without the language proposed by CoA Institute, it could be harder to hold NASA accountable for its compliance with the FOIA. Some agencies have taken the view that the “foreseeable harm” standard is inconsequential. Yet that view renders the standard mere surplusage, which is an unacceptable outcome. By adding a provision to implement the “foreseeable harm” standard, NASA would demonstrate its commitment to the law.

Our comment to NASA is part of our ongoing efforts to ensure that all agencies continue to update their FOIA regulations to reflect the current language in statutory guidelines. The FOIA is a vital component for efforts to ensure transparency and accountability in government, and CoA is committed to leveraging our expertise to encourage proper conformity with the law among all regulatory agencies. We have submitted 27 public comments to various rulemaking efforts since the passage of the FOIA Improvement Act of 2016, and we hope NASA will follow in the footsteps of other agencies who have adopted our recommendations to conform with the law.

Ryan Mulvey is counsel at Cause of Action Institute.

Loading...

Loading...

[1] Cause of Action v. Fed. Trade Comm’n, 799 F.2d 1108 (D.C. Cir. 2015)

[2] Sack v. Dep’t of Def., 823 F.3d 687 (D.C. Cir. 2016).

Institute of Museum and Library Services Adopts CoA Institute’s Recommendation for Revised FOIA Regulations

The Institute of Museum and Library Services (“IMLS”) finalized a rule today implementing revised Freedom of Information Act (“FOIA”) regulations that incorporates an important revision proposed by Cause of Action Institute (“CoA Institute”) in a comment submitted to the agency in January 2019. The IMLS is a small agency that provides federal support to libraries and museums across the country in coordination with state and local government.

CoA Institute made several recommendations in response to the IMLS’s proposed rulemaking. Most importantly, we urged the agency to remove outdated “organized and operated” language from its definition of a “representative of the news media.” That language has been used in the past to deny news media requester status—and favorable fee treatment—to government watchdog organizations, including CoA Institute.

In 2012, we sued the Federal Trade Commission, and took our case all the way to the D.C. Circuit, just to get the agency to acknowledged that its FOIA fee regulations were outdated and that it had improperly denied CoA Institute a fee reduction by relying on the “organized and operated” standard. In deciding that case, the D.C. Circuit issued a landmark decision in 2015, which clarified the proper fee category definitions and application of fees in FOIA cases. We cited this case to the IMLS and the agency took heed of the controlling case law, removing the outdated “organized and operated” standard from its final rule.

CoA Institute also asked the IMLS to remove language directing its FOIA officials to read agency regulations “in conjunction with” fee guidelines published by the White House Office of Management and Budget (“OMB”) in 1987. Portions of the OMB guidance, which are the source of the “organized and operated” standard, are no longer authoritative because they conflict with the statutory text, as amended by Congress, and judicial authorities, including Cause of Action v. Federal Trade Commission.

Continued reliance on the OMB guidelines is a source of confusion. In 2016, the FOIA Advisory Committee and the Archivist of the United States both called on OMB to update its fee guidelines. CoA Institute also filed a petition for rulemaking on the issue, and is currently litigating the matter in federal court. Although the IMLS has decided not to alter its reference to the OMB guidelines, the fact remains that no agency can rely on OMB’s superseded directives.

Since the passage of the FOIA Improvement Act of 2016, CoA Institute has commented on twenty-seven separate rulemakings. Of the twelve interim or proposed rulemakings that have been finalized, CoA Institute has succeeded in convincing nine agencies to abandon the outdated “organized and operated” standard in favor of a proper definition of “representative of the news media,” including the following:

- Department of Homeland Security

- Office of Special Counsel

- U.S. Agency for International Development

- Amtrak

- U.S. Postal Service

- Consumer Product Safety Commission

- Securities and Exchange Commission

- Presidio Trust

- Millennium Challenge Corporation

Other agencies, including the National Credit Union Administration and the Federal Reserve, chose to defer CoA Institute’s recommendations and have promised to propose further revisions in the near future to address outstanding fee issues. A small minority of agencies, which published direct final rules, have failed to acknowledge the continued deficiency in their regulations.

CoA Institute’s successful comment to the IMLS is another small step in our efforts to provide effective and transparent oversight of the administrative state and, more specifically, to ensure agency compliance with the FOIA.

Ryan P. Mulvey is Counsel at Cause of Action Institute

Newly Released Records Confirm IRS, DOJ Violated Taxpayer Confidentiality Law

Whether we like it or not, the Internal Revenue Service (IRS) plays a central role in the administration of our tax laws. The agency consequently possesses copious amounts of sensitive financial information about individual Americans, nonprofits, and other corporations. Congress considered the protection of such information so important that it has mandated its confidentiality. Section 6103 of the Internal Revenue Code requires that “returns and return information”—essentially, anything about a taxpayer in IRS files—“shall remain confidential.” The importance of taxpayer confidentiality, and the danger inherent in its unauthorized disclosure, is one reason why the 2010 “Tea Party” targeting scandal was so serious—the Obama White House weaponized the IRS to target individuals and nonprofit groups based on their perceived political alignment.

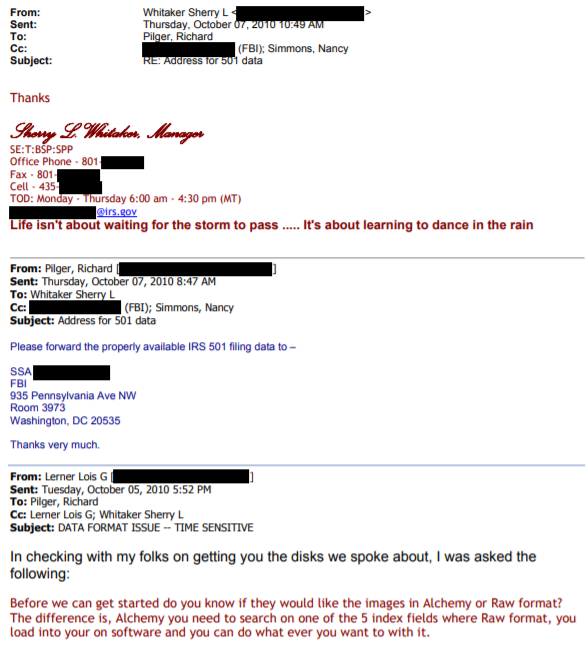

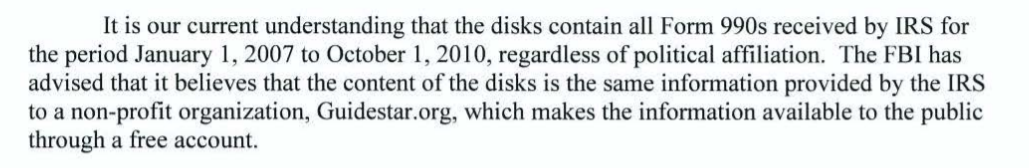

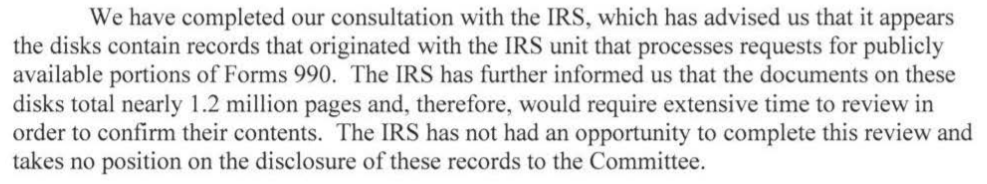

IRS records recently produced to Cause of Action Institute (CoA Institute) in a Freedom of Information Act (FOIA) lawsuit now shed further light on how carelessly the IRS and the Department of Justice (DOJ) handled sensitive taxpayer information and only belatedly admitted to Congress that they had violated taxpayer confidentiality. In 2012, CoA Institute began its in-depth investigation into the nature and causes of the IRS targeting scandal and the misdeeds of government bureaucrats such as Lois Lerner. Part of our investigation revealed that IRS officials, including Ms. Lerner, willingly handed over twenty-one computer disks, containing over 1.1 million pages of taxpayer information, to the DOJ Public Integrity Section and the Federal Bureau of Investigation (FBI), despite lacking proper legal authorization to do so. This allegedly was done as part of the previous Administration’s efforts to investigate exempt entities suspected of having engaged in prohibited political activity.

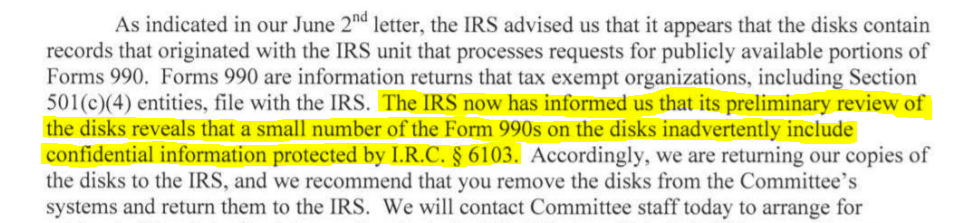

After repeatedly insisting that it had received only “publicly available portions” of Form 990s when the IRS turned over those 1.1 million pages of taxpayer information, the DOJ later admitted it was mistaken. The records received by CoA Institute confirm that was the case.

In two requests for investigation (here and here), CoA Institute explained why the IRS’s unauthorized disclosure constituted a serious breach of taxpayer confidentiality laws. But the DOJ Inspector General, while admitting that taxpayer data had been mishandled, choose to do nothing and merely stated that Congress had been “informed” and “this matter does not warrant further investigation.” The DOJ watchdog’s inaction led to a series of further FOIA requests (here, here, and here) that were designed to discover more about what the IRS and DOJ had done, and how Congress was alerted to the violation of Section 6103. CoA Institute obtained the requested records only after filing a lawsuit to compel disclosure.

Section 6103 sets out clear rules for the handling of tax information. Those rules are in place to protect taxpayer privacy. In this case, however, the rules were not followed. The DOJ never had proper authorization to obtain the nonprofits’ tax information, including information about donors. But the IRS nevertheless transferred 1.1 million pages of returns to the DOJ and agreed to provide the data in “raw” format, so that it would be easier for the FBI to process.

On May 29, 2014, after the U.S. House of Representatives Committee on Oversight and Government Reform opened an investigation into the unauthorized transfer of these tax returns, the DOJ claimed that it had obtained only publicly available information, such as the returns available online on Guidestar.org.

Days later, on June 2, 2014, the DOJ again argued that the trove of tax information it obtained from the IRS was not confidential.

And then, only two days after that, the DOJ changed its story—the agency admitted that the IRS had discovered confidential Section 6103 information within the 1.1 million pages of returns and return information. The DOJ claimed that the disclosure had been “inadvertent,” and it indicated that it was “returning [its] copies of the disks to the IRS[.]” Unfortunately, it is impossible to judge just how serious this “inadvertent” breach of confidentiality was because the DOJ has refused to furnish the House Oversight Committee with internal correspondence about the incident. It has withheld this correspondence by citing the deliberative process privilege—a species of executive privilege— and, to date, those records remain secret.

To be clear, by returning the twenty-one CDs to the IRS and informing Congress about what happened, the DOJ followed proper procedure. But that does not exonerate the federal government for having allowed the breach of taxpayer confidentiality to have happened in the first place. All citizens deserve to know their government does not act with political motivations, and that the IRS will safeguard sensitive taxpayer information, especially as it pertains to charitable giving and the operation of nonprofit entities.

The DOJ’s delayed disclosure of records, which finally give a complete picture of what happened, also illustrates another danger of politicization, namely, of the FOIA process. In this case, the DOJ put up so many hurdles to accessing these records that it required a lawsuit to compel disclosure. Even then, it took months for the agency to produce the records. It would have been next to impossible for an ordinary citizen to get the same result.

For government to be truly transparent, it must be held accountable by its citizens. The behavior of the IRS and DOJ in this case is a perfect illustration of why CoA Institute is committed to fighting for an open and transparent government. Government agencies should not be allowed to violate statutes and then stonewall requests that seek to expose the truth. That is why we pursued this investigation and why we will continue to vigorously serve as a government watchdog on behalf of every American.

Ryan Mulvey is Counsel at Cause of Action Institute.