Archives for 2014

Legal and Political Issues Raised by the Loss of Emails at the IRS

This memorandum addresses some of the legal and political issues raised by the Internal Revenue Service’s (IRS) records retention policy and practices in relation to the lost emails of Lois Lerner, former Director of the IRS’s Exemption Organizations unit.

Cause of Action Files Amicus Brief Before Supreme Court in Yates Case

Cause of Action, joined by Southeastern Legal Foundation and Texas Public Policy Foundation, has filed an amicus brief calling on the Supreme Court to overturn the conviction of a commercial fisherman who was prosecuted under Sarbanes-Oxley’s anti-shredding provision for throwing fish overboard. According to CoA’s Executive Director Dan Epstein, “the government’s conduct in this case is quintessential Executive Branch overreach. Congress never imagined, much less intended, that the law it passed to deter corporate financial scandals would be used the way it was here. If the National Oceanic and Atmospheric Administration’s actions stand, then the regulatory floodgates will open more Americans to government abuse.” CoA and the amici are represented by Gus Coldebella of Goodwin Procter LLP.

In the brief, CoA and the amici argued that if Captain Yates’ conviction is upheld, then a person who “conceals evidence of a surfboard being used on a beach designated for swimming, throws away a bag of chips from a workplace restroom prior to an OSHA inspection, fails to declare an item on a customs form at the airport, gets rid of a bat used in a teenager’s game of ‘mailbox baseball,’ or discards an empty container of medicine purchased from a foreign pharmacy” has violated SOX and faces up to twenty years in prison.

CoA and the amici also noted that Captain Yates’ case raises troubling questions about the government’s inconsistent application of the law, given the multiple cases of document destruction by federal officials. For example, in 2011, during the course of an Inspector General investigation into NOAA’s Office of Enforcement, then director Dale J. Jones, Jr. actually shredded documents to conceal evidence. Jones was not prosecuted—instead, he was given a different job. Similarly, Charles Edwards, former Department of Homeland Security Inspector General, allegedly destroyed documents to impede a federal investigation. Edwards, too, was reassigned to another federal job.

According to Epstein: “This is an obvious double standard: a taxpayer subsidized employee who destroys documents to obstruct an investigation (conduct clearly covered by the statute) is reassigned, while a taxpayer who throws fish overboard is sent to prison. No system that treats government employees differently than average citizens engenders respect for the law.”

Washington Times: Worse than Nixon? FOIA officers say Obama White House thwarting release of public information

Read the full story: Washington Times

Cause of Action, a government ethics group in Washington that uncovered the Craig memo from a federal whistleblower, said the White House should not intervene in FOIA decisions.

“The very people who are shielded from FOIA are now in charge of reviewing FOIA requests being sent to federal agencies,” said Daniel Epstein, the group’s executive director. “There’s a huge risk that the White House is influencing FOIA decisions of other federal agencies, assessing documents it otherwise may not have seen and is interjecting itself into the FOIA process, which is bad for transparency.”

Dan Epstein on the Peter Schiff Show 6/25/2014

Cause of Action’s Dan Epstein talks with Peter Schiff about the IRS targeting scandal.

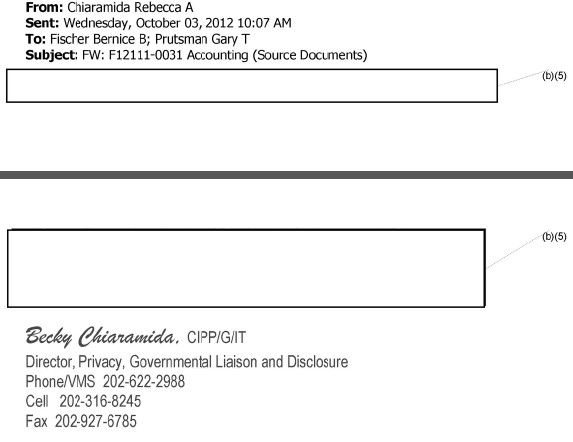

FOIA Follies: Here’s What Qualifies for a (b)(5) Redaction at the IRS

In October 2012, Cause of Action submitted a FOIA request to the Internal Revenue Service (IRS) seeking records related to any requests from the President for individual or business tax returns. In response to our request, the IRS released 790 pages of records but redacted a substantial amount of information pursuant to Exemption 5 of the FOIA. Exemption 5 protects “inter-agency or intra-agency memorandums or letters which would not be available by law to a party other than an agency in litigation with the agency.” Nate Jones of the National Security Archive recently called it the “withhold it because you want to” exemption. It is often triggered to protect the “deliberative process” among government employees, but DOJ guidance from 2009 notes that, “records covered by the deliberative process privilege in particular have significant release potential.”

Cause of Action decided to challenge the IRS’s application of Exemption 5. We filed and an appeal that the IRS denied, and then filed a lawsuit on June 19, 2013. In its response to our lawsuit, the IRS “reconsidered some of the redactions made to the 790 pages.” The resulting changes show how broadly IRS applied Exemption 5 to redact parts of certain emails. Here’s a sample of what the IRS redacted pursuant to the exemption (see the documents here):

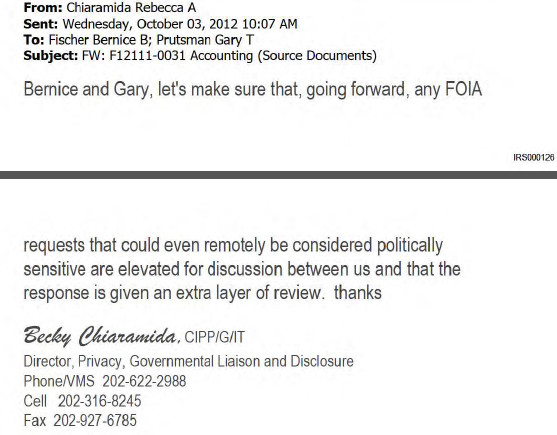

“Bernice and Gary, let’s make sure that, going forward, any FOIA requests that could even remotely be considered politically sensitive are elevated for discussion between us and that the response is given an extra layer of review. thanks”

Original Release

Unredacted

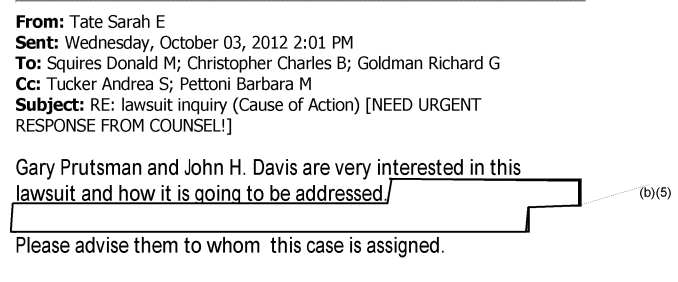

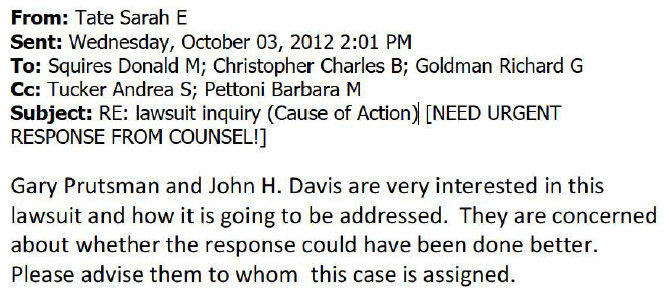

“They are concerned about whether the response could have been done better.”

Original Release

Unredacted

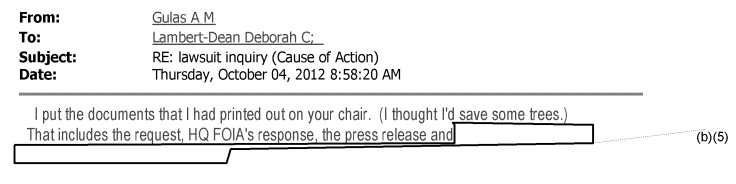

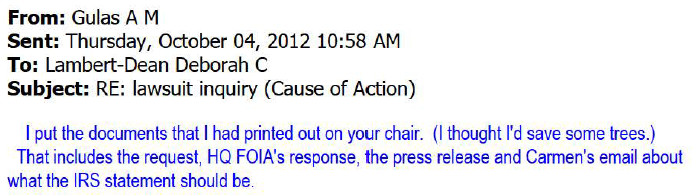

“Carmen’s email about what the IRS statement could be.”

Original Release

Unredacted

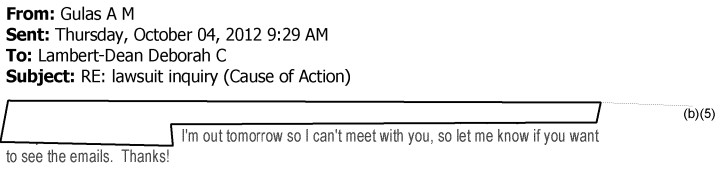

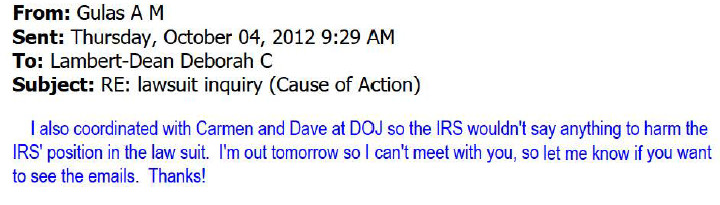

“I also coordinated with Carmen and Dave at DOJ so the IRS wouldn’t say anything to harm the IRS’ position in the law suit.”

Original Release

Unredacted

“Media Relations is attempting to refute allegations we are improperly hiding behind privacy laws.”

Original Release

Unredacted

“However, now that we’ve got the litigation threat, we have to determine if we were okay not to disclose the mere fact of WHETHER the president made any such requests at all, thereby disclosing the fact that either the documents did, or did not exist.”

Original Release

Unredacted

President Obama’s 2009 memo on FOIA declared, “In the face of doubt, openness prevails.” Attorney General Holder wrote, “[A]n agency should not withhold information simply because it may do so legally.” Despite these pledges, agencies are still choosing to hide information from the public. As these emails show, the IRS is abusing Exemption 5 to “withhold it because they want to.” Promises of transparency have not created more openness in government. Significant reform is needed to limit the abuse of FOIA exemptions so that citizens, journalists, and watchdog groups can continue to fight for accountability in the government.

Cause of Action Signs Coalition Letters in Support of FOIA Reform

Senators Leahy and Cornyn recently introduced the FOIA Improvement Act of 2014. This legislation makes several pro-requester improvements.

The legislation:

- Codifies the presumption of openness

- Puts limits on the use of Exemption 5

- Improves OGIS’s ability to report to Congress and the President

- Disallows agencies from using the unusual circumstances excuse to avoid waiving fees. If the agency fails to comply within the extended 10 days, it may not assess search fees.

- And other changes

Cause of Action signed two coalition letters with fifty organizations (organized by OpenTheGovernment.org) in support of FOIA Reform. OpenTheGovernment.Org’s press release can be found here.

FOIA Improvement Act Sign-On Letter 2014-06-19 by Cause of Action