Archives for 2013

Dan on WIBA 6/24/2013

Dan Epstein discusses how White House, Treasury politicize FOIA

SCNow: Florence leaders claim no wrongdoing in Smoke Free lobbying case

Florence leaders claim no wrongdoing in Smoke Free lobbying case

Officials and volunteers with anti-smoking movement blame DHEC for poorly run campaign, while Florence City Council members say they did no wrong.

By JOHN SWEENEY June 12, 2013

FLORENCE, SC – Former officials with Smoke Free Florence are saying they and members of the Florence City Council did nothing wrong during a campaign to pass a city wide smoking ordinance two years ago and are blaming a state agency’s heavy handedness for raising legal red flags.

“We don’t know if we still know the whole story or if we still know the truth about what happened,” said Clyde Nance, director of preventative services at Circle Park Behavioral Health Services.

Nance and Richard Sale, chairman of the Florence County Coalition for Alcohol and Other Drug Abuse Prevention, spoke out Monday in reaction to a story in the Morning News that ran Saturday regarding a report issued by the government watchdog group Cause of Action (CoA) that showed Smoke Free Florence illegally lobbied members of the Florence City Council to pass a smoking ordinance in 2011.

A separate report from the U.S. Government Accountability Office confirmed CoA’s findings and required the S.C. Department of Health and Environmental Control pay back $247.79 in funds deemed misused and required some staff members to attend additional ethics training.

The discrepancies came to light after local members of Circle Park and Smoke Free raised concerns over various practices by DHEC officials, including a request by DHEC to alter Smoke Free Florence meeting minutes so as not to show employees of the state agency was present during a meeting.

Nance and Sale said that was just one example of an unusual and often unsettling relationship with the state agency that was anything but efficient.

“It was such a strange partnership,” Nance said. “It was so different from anything that we’d ever done. It was so separated from the community and the state level.”

Sale, who served as chairman of Smoke Free Florence during its operation, has been involved with the Florence County Coalition since its inception more than 20 years ago. He said he’s never seen a project run the way that DHEC attempted to run the Smoke Free Florence campaign.

“I think it’s because they wanted to run it at the state level,” he said. “It was like they gave us the grant but they wanted to run it.”

Smoke Free Florence received $2.1 million of a $6 million grant made available by the American Recovery and Reinvestment Act.

The federal grant money was designated to educating youth to the dangers of smoking, assisting municipalities and school districts in enacting “smoke-free and tobacco-free policies,” and to offer health services dedicated toward helping smokers quit. The group utilized entities like Circle Park for that last piece, forming the group “Smoke Free Florence,” which no longer exists since the grant funding ran out .

“I was very proud of the coalition,” Sale said.

Sale and Nance aren’t the only ones bothered by the fact local individuals affiliated with Smoke Free Florence are no being mentioned in the same sentence as officials with DHEC who committed the violations.

Florence City Council members Buddy Brand, Glynn Willis and Octavia Williams-Blake said that since the initial story ran over the weekend they had received calls from family members and constituents asking if they did anything illegal.

All three council members said on Monday they were proud of the work they had down to tailor a smoking ordinance that fit the community. That ordinance include major changes from the original proposal DHEC proposed through Smoke Free Florence that would have had businesses losing their license if someone was caught smoking on their property. The new ordinance was more lenient, and according to Nance and Sale frustrated DHEC because it didn’t follow the “cookie cutter” document DHEC proposed.

Neither the report from CoA or the U.S. Government Accountability Office found local officials guilty of wrong doing, but did find fault with DHEC and forced the agency to pay a fine of $247.79 and required two employees receive additional training.

Sale said both the coalition and local officials approached the ordinance the right way, having debate and some give and take before a final decision was reached. Any notion that local individuals did something wrong, he said, was just not true.

Initially following the CoA report, DHEC issued a statement saying it had complied with the findings of the accountability office and considered the matter resolved.

A spokesperson for DHEC said Wednesday the agency had no additional comment.

For Nance, the incident has served as a lesson that the next time Circle Park or the coalition works with DHEC, they will be more careful in how they deal with their state partner.

“I think that the coalition will continue to take a look at their partnerships as they always have done and try to ensure that our partners will conduct themselves with the integrity and honesty and transparency that we do in the efforts that we have,” Nance said.

“The coalition holds itself to a pretty high standard and I think what we will look at in the future is try to make sure that anybody we partners with holds (themselves) to the same standard.”

White House and Treasury Department Politicize FOIA

In 2010, the Associated Press (AP) uncovered that the Department of Homeland Security (DHS) was blatantly politicizing the Freedom of Information Act (FOIA) process by having senior political appointees review requests. Additionally, it was revealed that documents implicating “White House equities” had been sent by DHS to the White House Counsel’s Office for review, but what are White House equities? And who is defining the term?

In subsequent testimony before the House Committee on Oversight and Government Reform, Mary Ellen Callahan, Chief Privacy Officer for DHS, was asked about the meaning of White House equities by Rep. Jason Chaffetz:

Mr. Chaffetz. Let me read another paragraph. “Two exceptions required White House review, request to see documents about spending under the $862 billion stimulus law, and the calendars for cabinet members, those required White House review,” is that correct?

Ms. Callahan. The calendars–anything that has White House equities would require White House review. That is—-

Mr. Chaffetz. What is a White House equity? What does that mean?

Ms. Callahan. In the circumstances with the Secretary’s calendar to the extent that she was in the White House, or that was a–disclosing some sort of element. This is a typical process of referring FOIA requests to different departments. It may be their underlying records. That is a standard process throughout the—-

Mr. Chaffetz. The other part of that is under the $862 billion stimulus; is that correct? Is that part of the White House equity? It says “Two exceptions required White House review. Request to see documents about spending under the $862 billion stimulus law,” is that correct?

Ms. Callahan. That is correct.

Mr. Chaffetz. Why? Why does that require a special White House review?

Ms. Callahan. Sir, I’m the chief FOIA officer; I’m not a policy person in this area.

Mr. Chaffetz. So is that a directive that you got from the White House?

Ms. Callahan. I believe I was instructed by the Office of the Secretary to do that, and we processed it—-

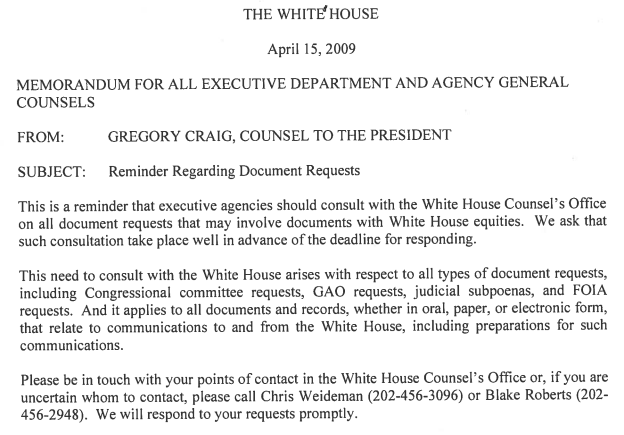

Three years after the above testimony, we have confirmed that Congressman Chaffetz was right about the source of authority that required “special White House review.” In January 2009, the President issued his Executive Order on FOIA and transparency, and then Attorney General Eric Holder issued a March 2009 FOIA memo encouraging disclosure. Both of these memos were made public and lauded as standards for federal agencies. But in April 2009, a previously undisclosed memo was sent from White House Counsel’s Office to Department and Agency General Counsels, reminding them to send to the White House all records involving “White House equities” collected in response to any document request. According to FOIA attorneys at multiple federal agencies, this White House consultation policy is still in effect.

The practice of sending agency records to the White House for review is not altogether new. In 1993, for example, the Department of Justice (DOJ) instructed agencies to send “White-House-originated” records to the White House Counsel’s Office whenever located in response to FOIA requests. However, the current White House consultation policy is substantially broader in scope. First, this memo expands the types of documents being sent to the White House to include Congressional committee requests, GAO requests, and judicial subpoenas. Additionally, the documents to be referred need not “originate” from the White House, as the DOJ advised in 1993, but need only involve “White House equities,” an undefined term that could be construed to include any records in which the White House might be interested. Indeed, that is exactly the type of referral that appeared to have occurred at DHS, and which is likely still occurring throughout the Executive Branch. In sum, the White House Counsel’s office is potentially receiving and reviewing, and actually demanding access to information they previously would not have been able to review under FOIA. Cause of Action is now seeking to obtain documentary evidence of this practice via FOIA requests to multiple agencies.

The 2009 memo that Cause of Action obtained:

How the Treasury Department and the IRS Stall FOIA Requests

- Treasury’s Departmental Offices (DO) and the IRS gives extra scrutiny to FOIA requests from all media requesters, delaying the release of records and usurping the regulatory authority of FOIA officials

- 13 requests to DO were marked for sensitive review were sent to the White House for review in 2009

In the wake of the DHS FOIA scandal, Senator Grassley and Congressman Issa sent a joint August 25, 2010 letter to 29 Inspectors General, asking them to investigate: (a) whether FOIA requests were given more scrutiny based upon the identity of the requester, and (b) the extent to which political appointees were systematically made aware of the requests and participate in FOIA decision-making. Our research found that only 7 of the 29 Inspectors General released their findings publicly, and none of those reports revealed any wrongdoing.

However, according to the Treasury Inspector General, both the Treasury’s main office, called Treasury’s Departmental Offices, as well as the IRS established formalized “sensitive review” processes in late 2009 that singled out media requesters and slowed down the FOIA process. At Treasury DO, a committee of senior Treasury officials reviewed requests deemed to be “sensitive” before career FOIA personnel were permitted to release any records. Notably, multiple government sources have confirmed that all FOIA requests submitted by the media were required to be forwarded to the review committee regardless of the content of the requested records. This discriminatory policy, which delayed the release of records and usurped the regulatory authority of FOIA officials, is all the more nefarious because it was established at a time when Americans were seeking to obtain vital information about Treasury’s response to a severe financial crisis.

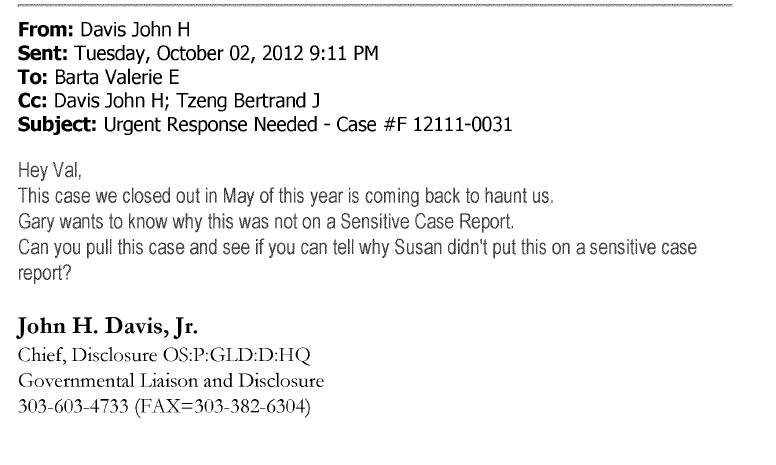

At the IRS, any FOIA request submitted by “major media” would be labeled as a “sensitive case,” and sent to the Chief Disclosure Officer and the Director of Communications, Liaison, and Disclosure, who would decide if documents were “appropriately disclosed.”

Interestingly, in response to a FOIA request that Cause of action sent to the IRS, the IRS admitted internally that it had forgotten to put us in a “Sensitive Case Report.”

According to the IG report, none of the other offices within Treasury had established a “sensitive review” process or were cited as sending requests to the White House for review.

Broken Promises on Transparency Continue

The Obama Administration cannot credibly claim to be the most transparent in history when it publicly issues memos about the presumption of openness in the FOIA process, for example, but then instructs agencies in a non-public memo to refer all records with “White House equities” to the White House for review. The White House is by its nature political and it is not subject to FOIA. Thus, it should not be interfering with the FOIA process. Not only is the FOIA process significantly stalled by this White House review — a fact that agencies zealously keep secret from requesters — but it permits the White House’s political interests to trump the correct application of the FOIA, a disclosure statute whose purpose is ensure an informed citizenry. In sum, this Administration is more concerned with appearing to be transparent than with actually being transparent.

The Fiscal Times: Dan Epstein: Lax IRS Oversight Fostered Costly Charity Scams

Lax IRS Oversight Fostered Costly Charity Scams

In addition to its clean beaches, rolling hills and exclusive real estate, Pacific Palisades, California, was home to the International Humanities Center (IHC), a tax-exempt sponsor of over 300 charitable endeavors. Its executive director, Steve Sugarman, rose to non-profit stardom by leading IHC-supported organizations to over $6 million in combined revenue.

But by December 2011, several IHC-sponsored projects received a shocking letter from Sugarman. It disclosed that IHC was “running a considerable deficit that has severely impacted all operations,” and warning the projects that future payments may not be processed.IHC became so successful so quickly that by 2009 the organization had to place a moratorium on sponsoring new projects. Sugarman’s secret was fiscal sponsorship – a term of art referring to tax-exempt 501(c)(3) charities that raise tax-deductible contributions on behalf of projects that lack the resources to operate as independent, tax-exempt charities themselves.

One month later, Sugarman informed IHC’s projects that their fiscal sponsor was shutting down. Donations to hundreds of charitable causes – and the sponsor entrusted with them – had vanished. The FBI subsequently launched an investigation into the apparent disappearance of an estimated $1 million in donations that about 200 non-profits reported losing when the organization abruptly shut down.

The story of IHC is not unique. Fiscal sponsors that engage in money laundering and fraud are systemic. And these CEOs are not on Wall Street or in the boardrooms of large, publicly-traded corporations. This kind of corporate fraud occurs in small, tax-exempt nonprofits, often run by one or two individuals who have discovered an opening in the tax code that allows them to dupe unsuspecting start-up charities and fly under the radar of an over-complicated tax code.

While the Internal Revenue Service got into trouble for targeting Tea Party groups, many fiscal sponsors have wrongly obtained charitable status to engage in a dangerous pattern of abuse that destroys jobs and ruins charitable aims toward the public good. Sadly, despite evidence of fiscal sponsors having fabricated tax documents and bank statements or mismanaged federal grant money, fiscal sponsorship has been unmanaged, unchecked, and undefined by the IRS.

The importance of IRS oversight of fiscal sponsorship is not just in the interest of those charitable projects that rely on the practice for their support – but for the American taxpayers as well. IHC received economic stimulus funding from the U.S. Department of Energy – yet no shovel-ready jobs were created.

In fact, the IHC’s use of these funds was subject to a DOE Inspector General investigation, with a criminal and civil case pending against IHC as of April 2012. Proper IRS oversight over fiscal sponsorship would have averted whatever bureaucratic wisdom concluded that IHC merited tax dollars or that it would employ out-of-work Americans.

Moreover, fiscal sponsorship has been abused in ways that threaten American security interests. Many are familiar with the Freedom Flotilla, which was led by the pro-Hamas Free Gaza Movement; it resulted in the death of nine people. But few are aware that the Free Gaza Movement is fiscally sponsored by a Washington, D.C.-based tax-exempt nonprofit, the American Educational Trust. For the IRS, fundraising for terrorism abroad apparently does not raise the same red flags as does being a “patriot” or supporting the constitution.

The IRS must regulate fiscal sponsorship by clearly defining the parameters and standards of the practice. Fiscal sponsorship agreements should be treated as contracts that identify the fiscal sponsorship arrangement between sponsor and client, as well as provide evidence that the sponsoring organization will exercise discretion and control over its client. The IRS, through rulemaking, should require that any 501(c)(3) organization that engages in fiscal sponsorship file with its Form 990 copies of all of its written fiscal sponsorship arrangements. Additionally, the IRS should require that fiscal sponsors disclose in their 990s when the gross receipts of a sponsored project exceeds $50,000.

Cases like IHC and the Free Gaza Movement underscore the substantial lack of guidance regarding fiscal sponsorship. Those gaps in oversight have exposed hundreds of charities to abuse and allowed substantial sums of donations – including federal government grants – to be mismanaged by unaccountable sponsors.

The IRS’s failure to properly oversee tax-exempt groups puts all projects that find themselves under an incompetent or disreputable fiscal sponsor at risk of losing funding and shutting down.

Dan Epstein is executive director of Cause of Action, a nonprofit, nonpartisan group that promotes government accountability and transparency. The group has filed a request with the IRS to develop rules and standards for tax-exempt fiscal sponsors.

Cause of Action Memos Impugn Obama Transparency Pledge

FOR IMMEDIATE RELEASE

June 20, 2013

Cause of Action Memos Impugn Obama Transparency Pledge

CoA obtains previously unreleased White House Memo detailing undisclosed FOIA policies

WASHINGTON – Cause of Action (CoA), a government accountability organization, today released a previously undisclosed copy of an April 2009 White House memo sent to all Executive Department and Agency General Counsels urging them to run all third-party requests dealing with “White House equities”– including congressional and Freedom of Information Act requests (FOIA)–through the White House Counsel’s office. This memo was sent just months after the President issued his January 2009 Executive Order on FOIA and transparency, and Attorney General Eric Holder’s March 2009 memo on FOIA—both of which were made public. According to the Department of Justice this memo is still in effect.

Additionally, CoA also obtained a previously unreleased copy of a November 2010 Treasury Inspector General report, revealing two concerning aspects of how the IRS and Treasury handle FOIA requests:

- The IRS treats “major media” requests as “special review,” therefore applying an additional layer of scrutiny and slowing down the FOIA process.

- The White House may have reviewed Treasury Department FOIA productions and claimed privileges before documents were released to the requestor.

Dan Epstein, Cause of Action’s executive director, commented on the consequences of these findings:

“We are concerned that the President’s transparency pledges and removal of the Office of Political Affairs may have all been a charade to not only politicize the Freedom of Information Act but to use the White House legal office to politicize the executive branch. The White House is not an agency subject to FOIA and should have no control over the FOIA process. The White House policy violates the intent of FOIA, which requires that federal agencies promptly respond to requests. The broad claim for documents relating to “White House equities” is unprecedented.

How are we to trust an Administration that has gone after the press and politicized the nation’s most important tool for knowing what its government is up to?”

Related Documents:

Treasury Inspector General Report