Washington D.C. – Cause of Action Institute (CoA Institute) today filed a lawsuit to compel production of records from the U.S. Department of Treasury dealing with the agency’s “sensitive review” policy. These policies often delay open records requests through the Freedom of Information Act (FOIA), particularly when such productions contain politically sensitive or potentially embarrassing information, directly contrary to congressional policy.

To better understand the Treasury Department’s sensitive review procedures, who is involved, and how it is used, CoA Institute submitted a FOIA request to the agency in June 2013 seeking records relating to its FOIA process.

CoA Institute Vice President John Vecchione: “It’s ironic that our FOIA to learn more about sensitive review has itself been held up because of sensitive review. Even after the Department of Treasury agreed through mediation last year to start producing responsive records, it has failed to produce a single document. Agencies have utilized opaque sensitive review processes to delay records requests, adding months and even years to an agency’s response time. The public has a right to information about how agencies obstruct and delay open records requests that may reveal politically embarrassing information.”

According to information obtained from various agency inspectors general, similar sensitive review policies have been used at the Department of Homeland Security, Department of Interior, Department of Commerce, Department of Agriculture, Department of Health and Human Services, Department of Housing and Urban Development, and the Department of Veterans Affairs. At some agencies, sensitive review is applied not only to information the agency’s management considers sensitive, but also to any FOIA request from a representative of the news media, like CoA Institute, or where the request is likely to attract media or political attention.

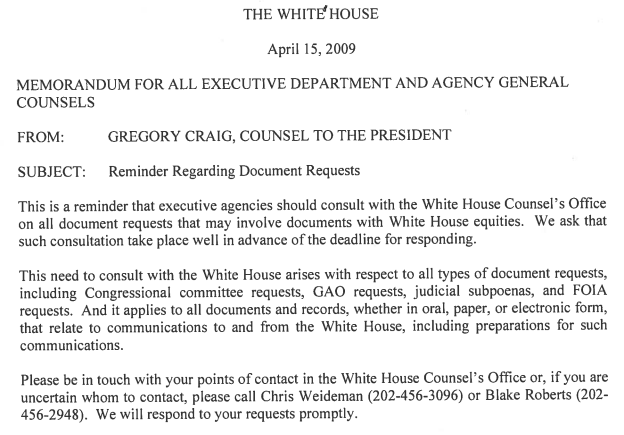

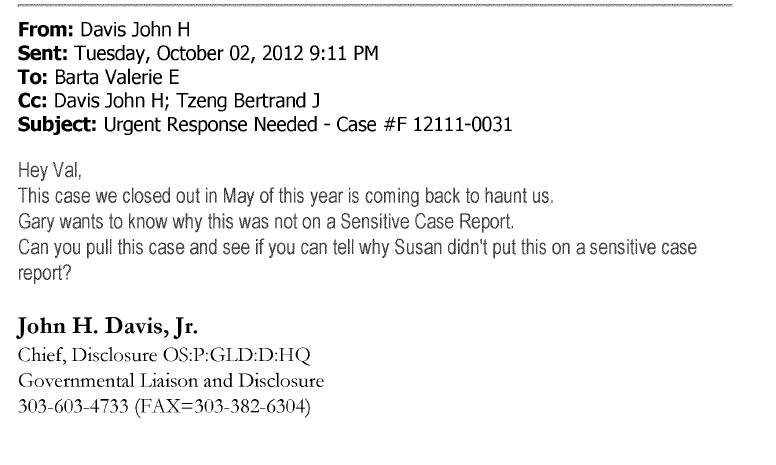

Sensitive review often is conducted by political appointees—and sometimes by the Office of the White House Counsel—rather than by career FOIA professionals. These appointees sometimes required staff to find and provide information about requesters that FOIA does not require requestors to provide, such as where the requestors live, who they work for, and whether their employer is politically active or part of the news media.

The full complaint can be accessed HERE

All exhibits can be accessed HERE