Groups committed to “revolutionary social change” sent proposals, met with high-level HUD officials

The Obama-era appears to have been a flush time for a number of favored special interest groups seeking hand-outs. It now appears that the previous administration’s pattern and practice of circumventing the congressional appropriations process to funnel money to third-party groups may have been more widespread than we thought. Beginning in 2013, the federal government entered into a number of settlements with major banks to resolve claims related to the issuance of residential-mortgage-backed securities. These settlements included billions of dollars in “consumer relief” payments that should have gone to the alleged victims, but instead were funneled to third-party organizations, including to those favored by the Obama administration.

CoA Institute has been investigating these settlements for several years and has recently uncovered documents indicating that some of these third-party organizations were directly lobbying high-level Housing and Urban Development (“HUD”) officials for a piece of the settlement pie. These documents are consistent with prior records discovered by the House Judiciary Committee regarding similar lobbying of Department of Justice (“DOJ”) officials.

In May of 2015, the House Judiciary Committee wrote a letter to the DOJ requesting information and documents relevant to the residential-mortgage-backed securities settlements. The information they received suggested that some third-party organizations were advocating for provisions that included mandatory donation requirements from which they would benefit.

One of the communications the House Judiciary Committee received was an email sent on November 8th, 2013 from the Leadership Conference on Civil and Human Rights (LCCHR) to the DOJ. In the email, LCCHR urged the DOJ to include funds in the JP Morgan settlement promoting community restoration and specifically seeking investment in Virginians Organized for Interfaith Community Engagement (VOICE) and their Metro Industrial Areas Foundation (Metro-IAF) affiliates. The DOJ also provided the House Judiciary Committee with an email from VOICE leadership to the head of legislative affairs at the DOJ. VOICE asked to set-up a meeting to make the argument that grants to community equity restoration funds be mandatory in all future settlements.

Commentators have noted that groups like VOICE and their IAF affiliates have “a commitment to what [they] call ‘revolutionary social change’” promoted through their own training institutes. One “objective of the training is to help leaders see the connection between their local issues and the broader national IAF objectives and associated progressive causes.”

CoA Institute recently received documents from HUD that are similar to those that the House Judiciary Committee received from the DOJ two years ago. CoA Institute filed a FOIA request for information on HUD’s involvement in the mortgage settlements. After filing a complaint against HUD for failing to disclose its role in the mortgage settlements, COA received documents including the segments below from HUD. The HUD documents reveal communications between HUD and VOICE, the same organization that had been lobbying the DOJ to receive settlement funds.

For instance, the following is an email between senior policy advisor Michelle Maiwurm, then working for Sen. Mark Warner (D-VA), and Damon Smith, then Principal Deputy General Counsel at HUD, discussing opportunities for third parties, such as VOICE, to submit proposals for the settlement agreement.

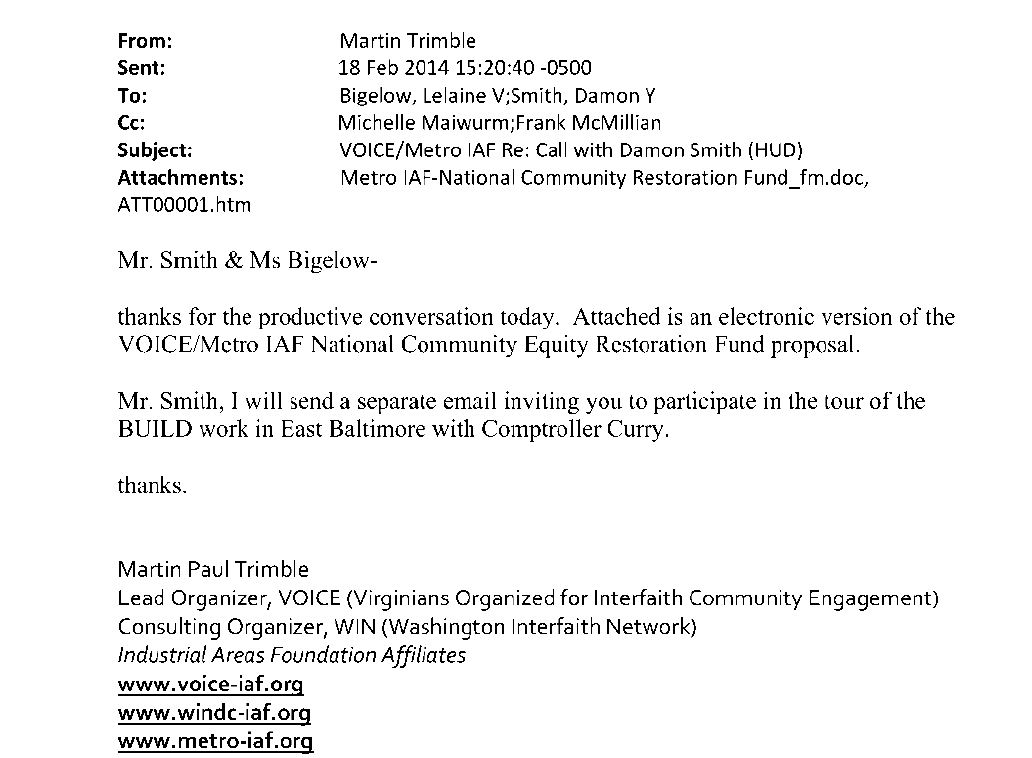

The lead organizer at VOICE, Martin Trimble, responds to a meeting with HUD officials Lelaine Bigelow and Damon Smith earlier that day and attaches the fund proposal.

Here are the relevant portions from VOICE’s proposal for the VOICE/Metro IAF National Community Equity Restoration Fund mentioned in the previous email correspondence.

The parallel evidence discovered from documents submitted to the House Judiciary Committee and those provided to CoA Institute helps explain why Attorney General Jeff Sessions recently prohibited DOJ from entering into settlement agreements that provide for payments to non-governmental, third-party organizations that are not parties to the dispute. In order to ensure this problem won’t reoccur in a future administration or with other agencies, however, Congress should pass the Stop Settlement Slush Funds Act of 2017. This bill would prevent all agencies, not just DOJ, from entering into these slush-fund agreements, would remove agencies’ ability to divert funds to politically-aligned third-parties and would allow them to be disbursed to actual victims of the alleged violations or deposited in the Treasury, as required by law.

Josh Schopf is Counsel and Cara Brown is Law Clerk at Cause of Action Institute, a Washington, D.C. non-profit oversight group advocating for economic freedom and individual opportunity.