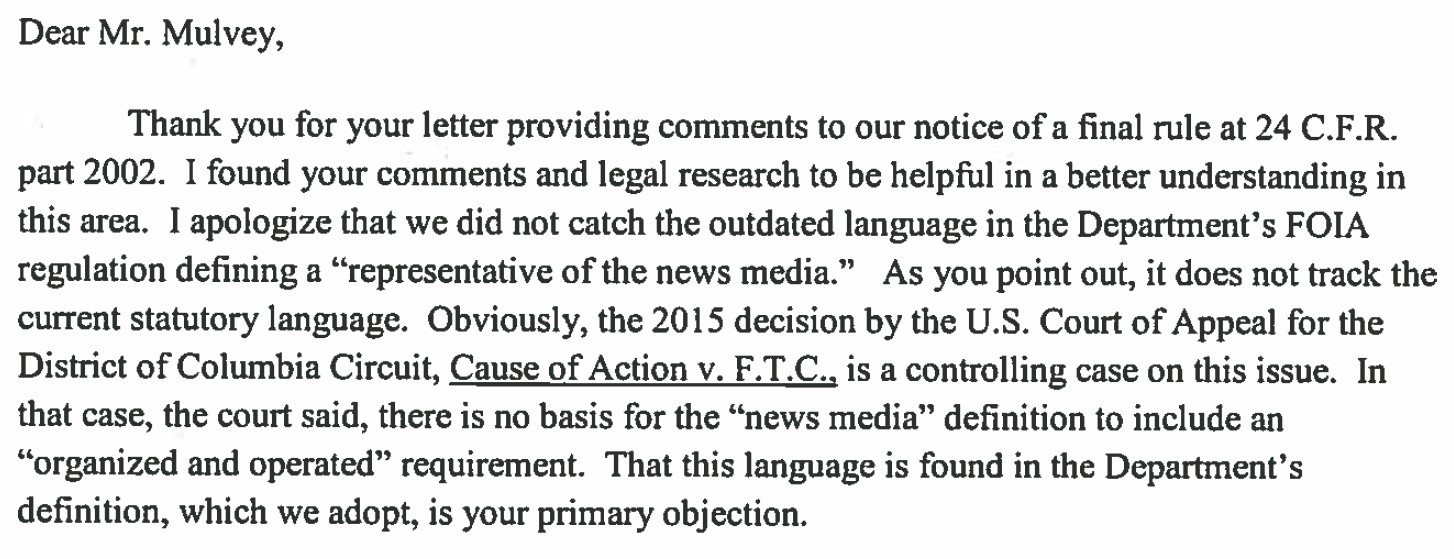

More than three years ago, Cause of Action Institute (CoA Institute) filed a Freedom of Information Act (FOIA) request for information related to the U.S. Department of Housing and Urban Development’s (HUD) involvement in the 2013/2014 multibillion-dollar mortgage settlements between the U.S. Department of Justice (DOJ) and Bank of America, J.P. Morgan Chase, and Citigroup. The settlements, drafted by a number of government agencies including HUD, were intended to make the banks pay compensation for their alleged involvement in faulty residential mortgage securities practices that contributed to the 2008 financial crisis.

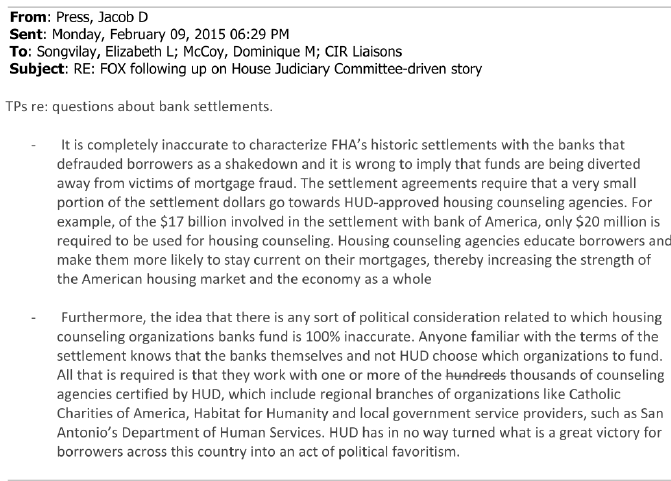

The agreements included “consumer-relief provisions” that required or permitted banks to provide billions of dollars in “donations” to government-approved third parties in lieu of paying funds to the U.S. Treasury. CoA Institute was suspicious of how this money would be given out, and we suspected favored special interest groups from the Obama-era were lobbying high-level HUD officials and seeking hand-outs. In 2016, CoA Institute filed a complaint after HUD failed to produce records responsive to our 2015 FOIA request, and in late 2016, the agency began producing responsive documents. As CoA Institute explained in a 2017 blog post, many of the early communications produced show evidence of the behavior we’re most concerned with. However, the most recent productions reveal an additional troublesome fact – there was a significant amount of uncertainty among influential HUD officials regarding the details of the agreements that led to HUD employees scrambling to answer settlement-related questions posed by popular media outlets.

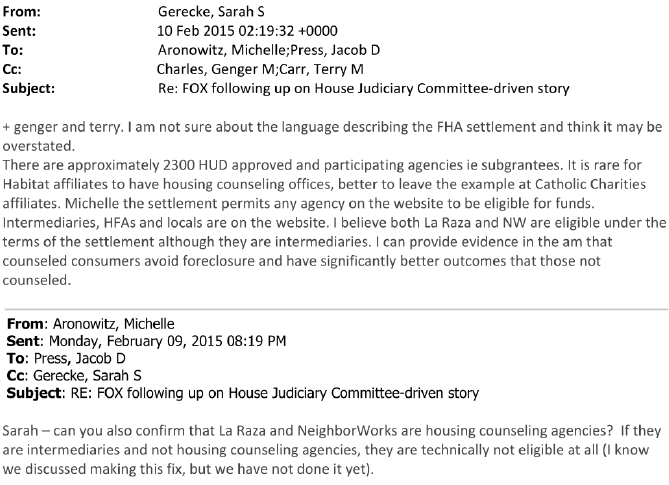

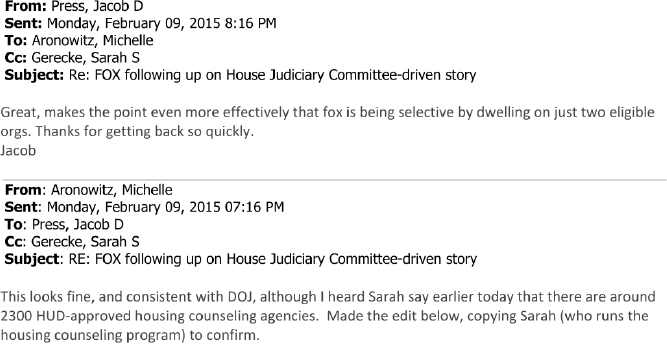

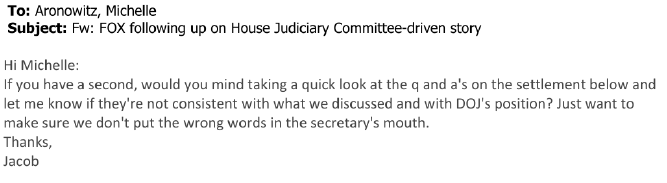

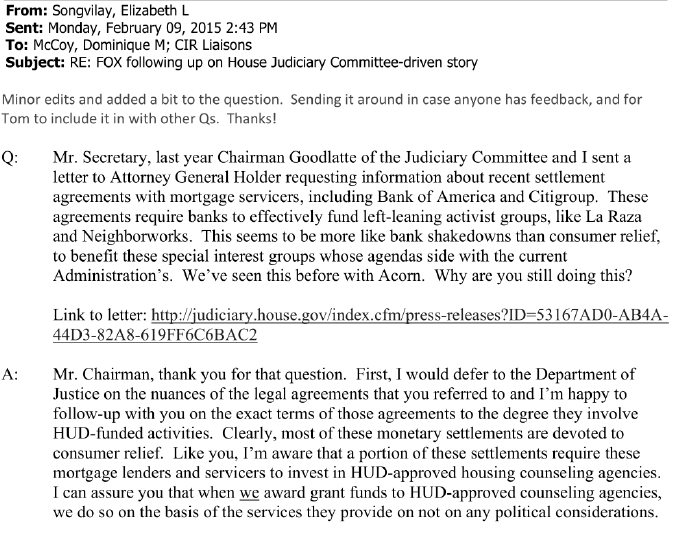

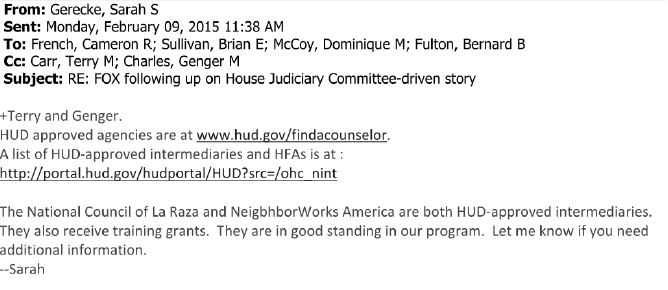

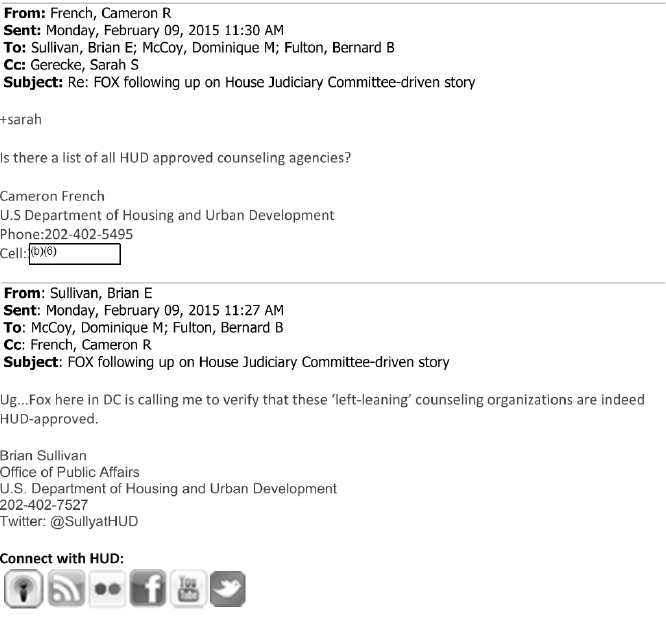

The following screenshots are excerpts of internal HUD email communications regarding an inquiry from Fox News in 2015, about a year after the settlements were finalized. A Fox News reporter questioned whether La Raza and NeighborWorks America, both intermediaries[1], were “HUD-approved” and eligible to receive funding under the terms set forth in the settlements. Despite being responsible for providing the list of eligible beneficiaries for consumer-relief donations, HUD officials reveal in these communications a significant amount of uncertainty, confusion, and disagreement regarding what organizations are eligible to receive such donations. Specifically, they struggled to determine whether intermediaries and housing counseling agencies or solely housing counseling agencies were entitled to receive the funding. The screenshots included below are only pieces of the full email thread that continued for many pages as HUD personnel went back and forth with each other in an attempt to find answers.

Most of the individuals included in these emails were not only senior HUD officials at the time of the correspondence, but they were also in similar, if not the same, positions at the time the settlements were drafted. Those individuals included: Michelle Aronowitz was the Deputy General Counsel for Enforcement and Fair Housing from October 2009 until January 2017; from about 2009 until 2017, Jacob Press was a legal counsel and worked in HUD’s congressional relations office; Edward Golding was a senior advisor until April 2015 when he became the Principal Deputy Assistant Secretary for Housing; Sarah Gerecke remains the Deputy Assistant Secretary at the Office of Housing Counseling, the same role she had when the settlements were drafted.

The confusion illustrated in these communications raises a number of questions, including why didn’t these prominent HUD officials know which types of organizations (e.g., intermediaries, housing counseling agencies, etc.) were eligible to receive funding? And, why did it take so long to determine which organizations were considered “HUD-approved housing counseling agencies”? These are questions that should have been resolved in 2013 when the settlements were being drafted rather than a year after they were finalized. This confusion further illustrates the disturbing nature of these agreements, which benefited a substantial number of third-party organizations at the expense of those harmed.

A complete copy of the most recent HUD production that contained these emails can be viewed here and here.

[1] HUD-Approved Intermediaries provide supportive housing counseling services through a network of affiliates or branches. Services include training, pass-through funding, technical assistance, and overseeing their networks to ensure services are satisfactory. In contrast, HUD-Approved Housing Counseling Agencies directly provide advice on buying a home, renting, defaults, foreclosures, and credit issues.

Libby Rudolf is a litigation support analyst at Cause of Action Institute.