Last Thursday, Dan Epstein, Cause of Action’s executive director appeared on WDEL’s The Rick Jensen Show to talk about the scandal surrounding the IRS’s exempt organizations unit and recent discoveries it specifically targeted conservative organizations when applying for the tax-exempt 501(c)(4) status. Rick asked the questions and Dan dished out the answers. Here are some of the highlights:

Rick: There are so many people that don’t believe that using the IRS as a weapon is illegal and is a big scandal. So what? Lots of presidents have done this. It’s not a scandal. Why should we care?

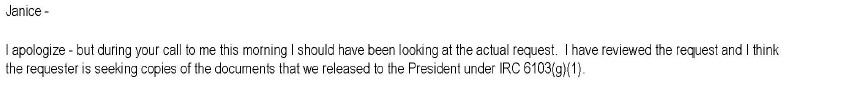

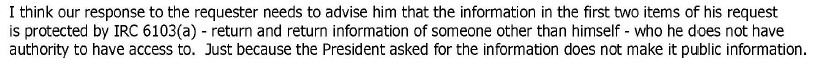

Dan: Actually, not a lot of presidents have done this; in fact the Internal revenue code—the whole reason why we were able to get transparency on what Nixon was doing and allegedly Johnson and Kennedy was because there’s a specific provision of the tax code that specifically authorizes the President to get tax information and he has to report that back to Congress. Cause of Action investigated this…we found that in fact even though the President had appeared to have gotten private information of certain entities he did not use the statutory mean s to do that.

So why should we care? We should care because:

1) We want a President, an Administration that follows the law.

2) It’s not just the issue of political corruption or political targeting; it’s the silencing of free expression. When you’re a non-profit and an organization that wants to get a tax-exempt status and you apply to the IRS, part of what that IRS application and certification does… it’s the government approving you to engage in certain protected expression. When you don’t’ approve them and when you actually are engaged in selective politicization in terms of whom you approve, you’re violating the most important amendment in the United States Constitution, that’s the First Amendment, that’s the freedom of speech, the freedom of expression, the freedom of no government-established religion. And when you infringe on that, you’re fundamentally infringing on something has been most key to the expression of our basic rights.

Rick: The Tea Party…they don’t want to pay taxes. They should be investigated. The IRS investigating Tea Party is the right thing… the IRS is doing the right thing, right?

Dan: It’s actually quite ironic because the Inspector General’s report from the IRS—TIGTA actually showed that in fact if the IRS was really just concerned about groups that are doing political activity then the IRS actually was in fact under-inclusive. In fact, most of the Tea Party groups that the IRS investigated were actually not doing any political activity and were educational or social in community-outreach organizations. Yet in fact, there were left-of-center groups that applied for tax-exempt status that were granted it and yet clearly—according to the Inspector General—were engaging in political activity.

So if anyone needs to be audited, if anyone need s be investigated, it’s not the majority of the Tea Party groups, it’s the left-of-center groups. And in fact the person is incorrect because the Inspector General, the government official who investigated this stated that as a matter of fact most of these Tea Party groups were not interested in engaging in policy.

Rick: Asking some group to answer a few questions is not intimidating. These Tea-Party people they’re just whining and trying to make something out of nothing. Big deal- you have to answer a few questions. How the heck can that be intimidating or harassment?

Dan: There are a number of issues there. It’s not just as if they’re asking a few questions.

1) They’re asking for in many cases, disclosure of donors, disclosure of contributors, and in other cases they’re asking specific questions that relate to how you would answer certain political questions. So the IRS has no authority to do those types of things. The IRS does not actually have the authority to respectively use the examinations process as an audit process.

2) It merely wasn’t just a few questions, because in other instances, the IRS actually conducted audits which are a costly enterprise- you have to hire lawyers. Most organizations have to hire lawyers anyways to apply for an exempt status… it’s not just a question of having to deal with questions, its having to deal with questions that very much take the posture of an investigation, or as we now know, were actual audits.

Rick: Regarding the disclosure of donors and contributors to these groups we (the public) want to know who’s funding these groups and who’s behind them and behind this. [Shouldn’t the IRS be investigating this?]

Dan: When you’re applying for exempt-status as a 501(c)(4) which is basically a social-welfare organization, what the IRS is trying to determine is in fact, should you be a 501(c)4 or should you be a section 524 – a Political Action Committee (PAC)? That’s really what the examination process is geared towards. It has nothing to do with donors. It has everything to do with what is the evidence that you’re going to be engaging in social welfare activities verses pure politics.

Rick: What’s with the IRS sending the names of donors to the media? When you actually send these names illegally to a group like ProPublica they can use the list of these names against them in public.

Dan: What the IRS did in disclosing those lists to ProPublica is illegal. Imagine if the IRS was to take any of our tax returns and just give it to a news organization. That is a violation of law.

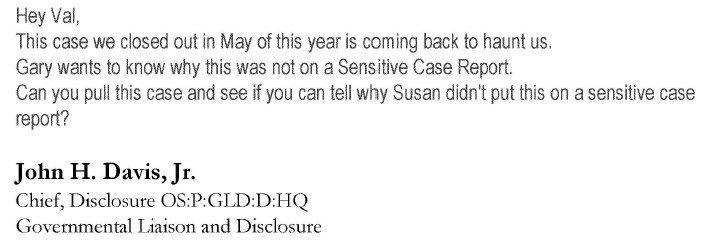

Rick: So the question is…. these phony retirements. You’ve got two people who are going to retire anyway, and Obama is saying, “Okay we fixed it, we’re retiring them early.” So who goes to jail?

Dan: What we know is that so far, the only things that have happened from the criminal side is that Attorney General Holder has asked the FBI to investigate. Congress doesn’t have the authority to recommend prosecution. It looks like the claim is that these were just a few rogue employees. The likelihood is that the FBI will find no criminal wrongdoing, that’s typically what happens with these types of issues. It may just be a slap on the wrist.

Rick: Is it a problem that Eric Holder is in essence investigating himself, recusing himself and saying, “I may be a whistleblower myself”? Should we have a special prosecutor? Who oversees Holder?

Dan: I think we need to do one of a few things:

1) Congress either needs to set up a special committee to investigate the IRS –which it can do and empower through emergency legislation— it can either make it an Article 1 Committee, which is legislative or it can make it an executive branch committee and give it prosecutorial power. Congress has the authority to do that.

2) What can happen (and this likely not to happen) is that the Attorney General, or if he has a conflict of interest, the Deputy Attorney General could appoint an Independent Counsel or a Special Counsel which would actually have much of the prosecutorial authority as the Attorney General himself.

3) In any of these legal cases that have now been filed, whether the case in Ohio or the case filed in the U.S. District Court for the District of Columbia – in either of these cases, a judge (based off the necessity of fact gathering) can appoint an Independent Prosecutor and assign an Independent Counsel to prosecute these issues. A federal judge has the opportunity to recognize the importance of independence here.

For more information on Cause of Action’s investigation into the IRS click here.