Department of Defense FOIA offices are prohibited from responding to “significant” FOIA requests having “departmental level interest” without approval from the Pentagon, according to a policy document obtained by Cause of Action from the DoD’s Inspector General.

A “significant” request is defined by the policy document as one where, in the judgment of a FOIA office, “the subject matter of the released documents may generate media interest and/or may be of interest or potential interest to DoD senior leadership.” This can include requests regarding “the current administration (including request for information on Senator Obama) previous administrations, and current or previous DoD leadership.”

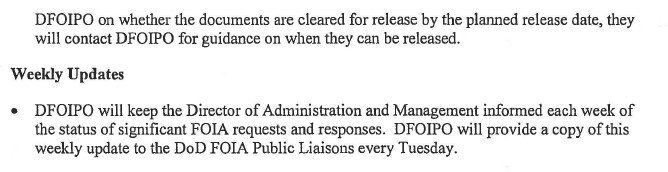

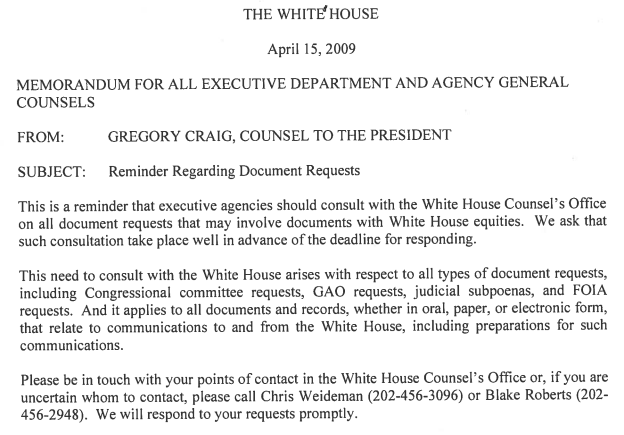

The policy document further provides that if a “significant” request generates “departmental level interest,” the DoD FOIA office handling the request must forward its proposed FOIA response and all responsive records for departmental level clearance. Departmental level clearance is done at the DoD Freedom of Information Policy Office (DFOIPO) which is responsible for the formulation and implementation of FOIA policy guidance for DoD. The office was created in 2006 after President Bush signed an Executive Order aimed at improving the FOIA process, though the policy document in question was drafted only after President Obama took office.

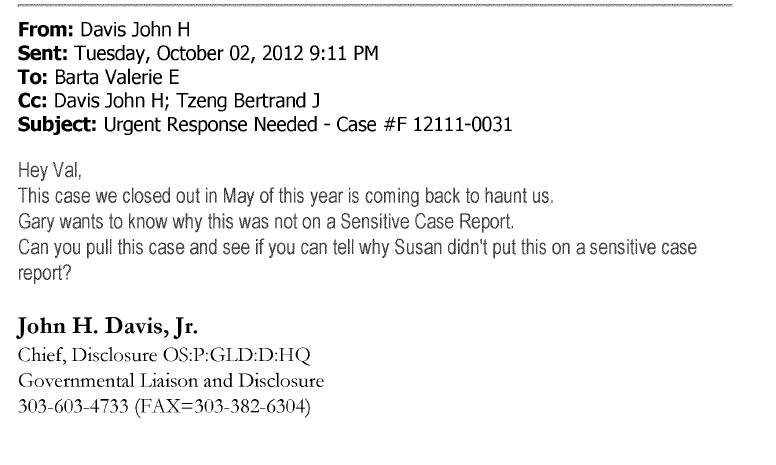

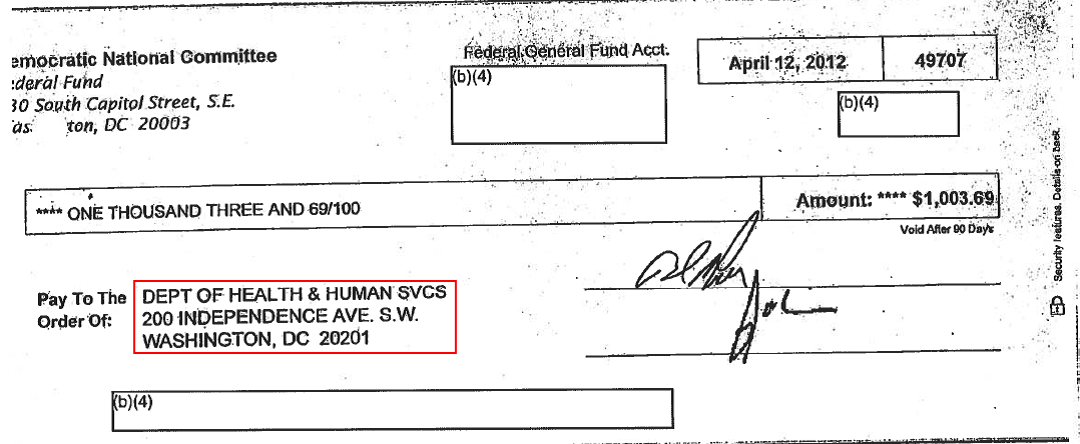

The Pentagon’s FOIA review policy was initially revealed by the IG to Congress in 2010 in response to an inquiry concerning the politicization of FOIA. The IG did not comment on this policy or on DoD’s FOIA practices; it merely forwarded documents to Congress. Notably, neither the IG nor the Pentagon has proactively disclosed any of this information to the public.

This secrecy is especially troubling with respect to DFOIPO in light of its mission. Not only is this policy document omitted from a long list of “FOIA Policy Guidance” on DFOIPO’s Web site, but none of DFOIPO’s other publicly available FOIA material even mention this Department-wide policy. Those documents include DoD’s “Freedom of Information Act Handbook,” its annual FOIA reports to the Department of Justice, as well as a bi-annual newsletter “DoD FOIA News.” This is hardly the stuff of which transparent administrations are made, let alone one that claims to be the most transparent in history.