As we recently discussed, a district court ruled against cigar manufacturers and upheld onerous new labeling requirements imposed by the Food and Drug Administration (“FDA”). The case is not over, however, as the cigar plaintiffs have decided to appeal to the Court of Appeals for the D.C. Circuit.

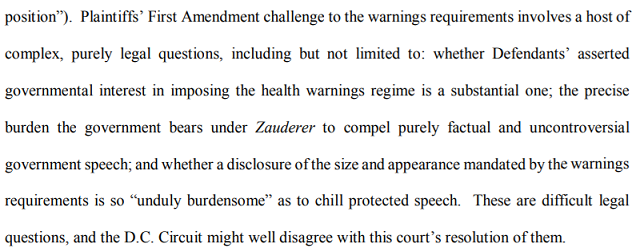

Just yesterday, as a result of the pending appeal, the district court judge issued an order blocking the FDA from implementing any of its labeling regulations without first hearing from the D.C. Circuit. This might seem odd at first: didn’t the judge originally rule on behalf of the FDA? Why is the agency now blocked from enforcing its regulations? The judge determined that–because the regulations are costly and the legal questions are so important–it’s better to wait for the appeals court to decide the case before allowing the FDA to enforce the ban. He conceded that many of the issues in the case, including essential First Amendment questions, are purely legal. Therefore, it’s possible that the appeals court could disagree with his ruling.

Most interestingly, the judge cited the Supreme Court’s decision from just a couple weeks ago in National Institute of Family and Life Advocates v. Becerra, which held that a California law requiring pregnancy clinics to provide certain information to their patients likely runs afoul of the First Amendment. The cigar companies argued that Becerra is strong evidence that the court of appeals would overturn the district court’s ruling here. Even though the judge disagreed, he did concede that “Becerra makes clear that Plaintiffs’ appeal raises serious legal questions.”

This latest ruling provides a temporary respite for cigar companies as they take their appeal to the higher courts. Here’s hoping common sense and the rule of law prevail.

Eric R. Bolinder is Counsel at Cause of Action Institute. You can follow him on Twitter @EricBolinderLaw.