Below are two selected documents from the most recent OGR report on FDIC’s involvement in Operation Choke Point.

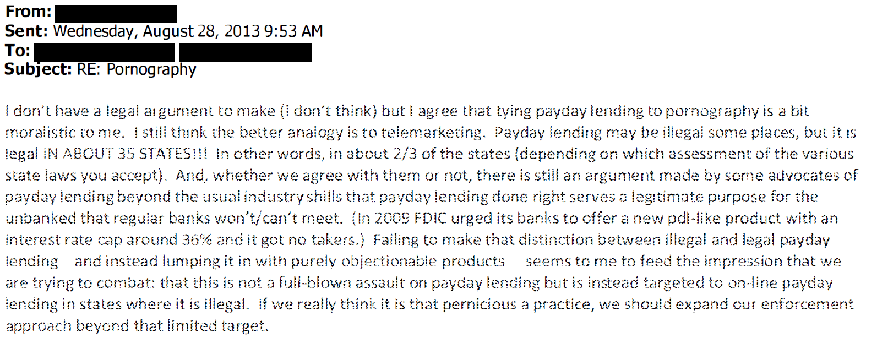

August 2013 email between FDIC officials regarding state regulation of an industry targeted by Operation Choke Point:

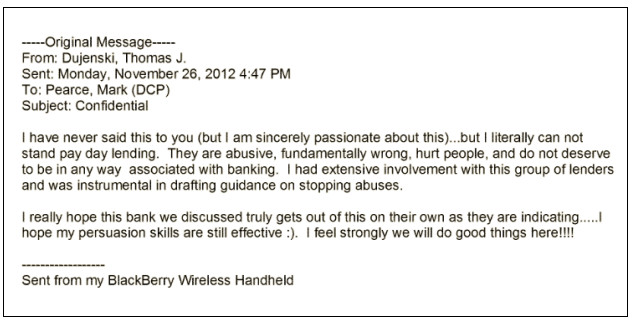

November 2012 email from Thomas Dujenski, (FDIC Regional Director, Atlanta), to Mark Pearce, (Director, FDIC Division of Depositor and Consumer Protection), regarding Dujenski’s viewpoints on the same industry: