Washington D.C. – After President Trump yesterday signed an executive order to review previous presidents’ national monument designations under the Antiquities Act, Cause of Action Institute (“CoA Institute”) today sent a letter to Interior Secretary Ryan Zinke outlining why some designations may have been unlawful.

Signed into law over a century ago, the Antiquities Act authorizes the president to declare federal lands as part of monuments, which restricts how the lands can be used. Records obtained by CoA Institute indicate that some of President Obama’s designations may have resulted from collusion with outside environmental groups, while ignoring feedback from the local stakeholders who would be most harmed.

CoA Institute President and CEO John Vecchione: “Major decisions impacting Americans’ livelihoods, vast public lands, natural resources, and property rights are currently left to the sole discretion of the president. This is contrary to most of our system of government. Presidents failed to substantiate many designations in any meaningful way, beyond the use of a few magic words on the face of the proclamations. Unchecked discretion and lack of recourse to remedy overbroad proclamations has resulted in misuse of the Antiquities Act and undue restrictions on future use of vast swaths of federal lands.”

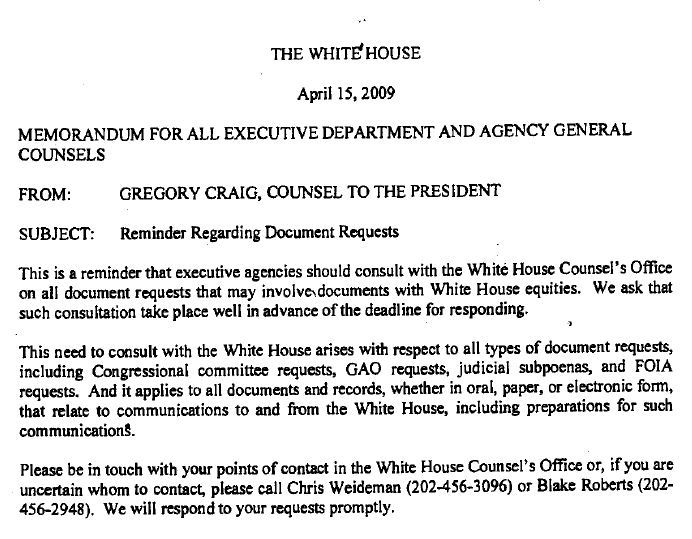

CoA Institute has submitted more than 10 Freedom of Information Act (“FOIA”) requests to various agencies and executive branch offices involved with national monument declarations.

Evident from government records received and reviewed by CoA Institute, monument declarations have been made with little or no consideration of local stakeholders and those most adversely impacted by the designations. More recent designations, such as the Northeast Canyons and Seamounts Marine National Monument and the expansion of the Cascade-Siskiyou National Monument have even been made in direct contravention of longstanding statutory frameworks established by Congress and trusted by local stakeholders.

To date, CoA Institute has received several interim releases, including over 1,000 records, but we anticipate that this represents only small fraction of the records that are responsive to our requests. These records, along with publicly available documents and conversations we have had with local stakeholders in multiple states, preliminarily confirm several of our concerns.

For example, it appears that third-party environmental groups knew about a forthcoming monument designation in the Atlantic Ocean prior to August 2015. However, local fishermen—who would be directly and adversely impacted by the designation— were notified only 12 days before the September meeting. As indicated in records we have reviewed, local fishermen were given only 250 words in a press release informing them of the meeting and seeking input on a then-undefined proposal. In contrast, third party organizations had enough in-depth information in advance of the meeting to build online petitions supporting a monument in the Atlantic Ocean that were pushed out to their members nationwide.

As part of our ongoing oversight, CoA Institute continues to investigate:

- The role certain Members of Congress played in lobbying President Obama to take unilateral action under the Antiquities Act;

- Potential collusion between outside groups and the Obama Administration to declare national monuments;

- Lack of transparency regarding monument designations;

- Pretextual public hearings relating to predetermined monument designations;

- The continued acquisition of private lands in and around existing national monuments to expand such monuments; and

- The legality of agency rulemakings to enforce Antiquities Act designations.

The full letter can be found here

For information regarding this press release, please contact Zachary Kurz, Director of Communications at CoA Institute: zachary.kurz@causeofaction.org