Washington, D.C. – The U.S. Court of Appeals for the District of Columbia today reversed the District Court’s ruling, siding with Cause of Action Institute’s (CoA Institute) client, Limnia Inc., an advanced vehicle technology company that alleged it was unfairly passed over for a government-backed loan and loan guarantee through the Department of Energy’s (“DOE”) politically-driven programs.

CoA Institute President and CEO John Vecchione: “We are very gratified for the Court’s decision. The Circuit saw things our client’s way. We look forward to further advancing this case upon remand. But this is an important precedent laying out the parameters of voluntary remand to an agency.”

CoA Institute filed a lawsuit in 2013 on behalf of Limnia Inc. after the Department of Energy (“DOE”) failed to give the company fair treatment and the honest opportunity to compete for a government-backed loan under the agency’s controversial loan guarantee program to build advanced technology vehicles and components.

In 2008 and 2009, Limnia submitted two loan applications for $15 million in funding through DOE’s Advanced Technology Vehicles Manufacturing (“ATVM”) program. Limnia specializes in the production of battery systems for electric cars and applied for funding to develop a new advanced vehicle energy storage system. The DOE rejected both of Limnia’s applications.

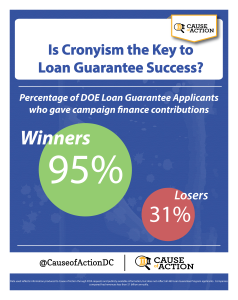

Limnia sued DOE in the District Court alleging that the rejection of its applications was unlawful under the Administrative Procedure Act. In its complaint, Limnia argued it was passed over in favor of politically-favored competitors, such as Tesla Motors Inc., which had close connections to the Obama administration. Tesla received hundreds of millions in loans from the ATVM in early 2010.

Before the District Court could decide Limnia’s case on the merits, however, DOE requested that the case be remanded back to the agency. The District Court granted DOE’s request, returning Limnia’s case to the agency and closing Limnia’s judicial action. In today’s opinion, the Court of Appeals found that the District Court’s decision functioned as a dismissal of Limnia’s claims and authorized further judicial proceedings.

Limnia Inc. Chairman and Vice President of Product Innovation Scott Douglas Redmond: “We fought this fight on behalf of everyone who is sick of cronyism and corruption in Washington DC and tired of having their tax dollars used against them by corrupt political insiders. This is part one of a victory, not only for our team, but for the average citizen who doesn’t want their tax dollars going to politically connected projects.”

The full opinion is available here

Visit our blog for analysis of the opinion and more information about the case here

For information regarding this press release, please contact Zachary Kurz, Director of Communications: zachary.kurz@causeofaction.org