(Photo via Politico and BGA Think Tank)

A little-known provision of the Internal Revenue Code, IRC § 6103(g), allows the President of the United States to request the tax returns of any individual or business he wishes. Concerned that the President may be asking for tax returns in order to retaliate against opponents of his administration, in March 2012 Cause of Action submitted a FOIA request to the Internal Revenue Service (IRS) seeking records of any presidential requests for these returns. The IRS denied our request in May, citing a provision that prohibits the release of private tax return information. Since Cause of Action asked only for any presidential requests for returns, not the returns themselves, we appealed the IRS’s decision. When the IRS denied our appeal as well, we sued for the documents’ release while also submitting an additional FOIA request seeking communications concerning our original request.

After months of back-and-forth between Cause of Action and the IRS, in October 2012 we were stunned to learn that the documents we’d been requesting since March had never even existed! According to the IRS Office of Disclosure, since the law’s inception in 1976 no president had ever requested tax returns through § 6103(g). Why it took the IRS seven months to disclose this important bit of information, plus a bona fide freak-out by IRS Counsel and Disclosure staff, is revealed in the following documents [Large file warning] received by Cause of Action in March 2013.

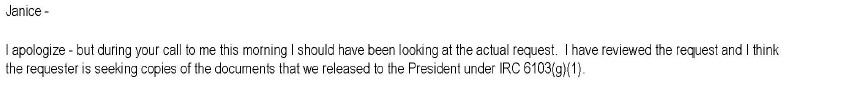

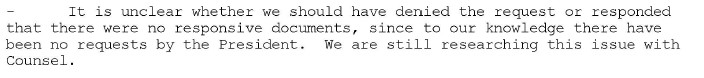

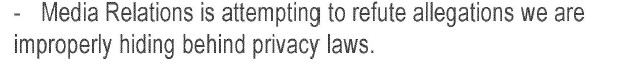

Take a look at these excerpts from an e-mail between Tax Law/ FOIA Specialists Valerie Barta and Janice Rudolph, dated May 21, 2012:

Ms. Rudolph agreed, concluding that Cause of Action was not privy to information regarding presidential requests for tax returns. Note that these specialists appeared to operate under the assumption that the records did, in fact, exist.

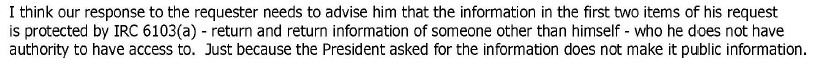

Cause of Action eventually filed suit on October 2, prompting immediate finger-pointing in the IRS’ FOIA division:

Ms. Barta’s response is telling:

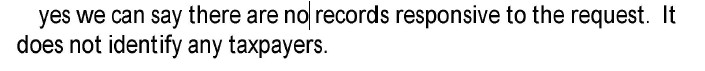

Way to throw a colleague under the bus, Val. Ms. Barta and Ms. Rudolph both seemingly failed to inform management why they denied Cause of Action’s request or to convey the seriousness with which we threatened to take legal action. In fact, it appears that the two neglected to conduct a due diligence review of potentially responsive documents, instead relying on poor legal reasoning to prop up their contention that the documents would be exempt from disclosure. After we filed suit, IRS analyst David Nimmo returned to the issue and made a surprising discovery.

An excerpted e-mail from the afternoon of October 2:

Forgive us for feeling a little miffed that the IRS didn’t research this issue with Counsel before denying both our request and appeal. And since it took Mr. Nimmo a matter of hours to ascertain that no records existed, what exactly prevented Ms. Barta and Ms. Rudolph from conducting that most basic of searches five months previously?

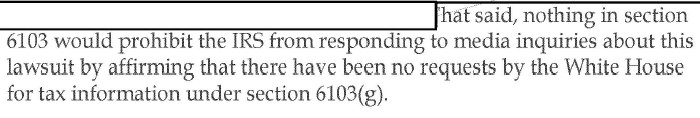

Counsel’s research soon yielded an answer to whether the denial was done in error.

Senior Technician Reviewer Don Squires on October 3:

Counsel A.M. Gulas:

And Chief of Disclosure Gary Prutsman:

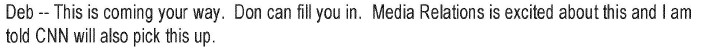

With it now established that the IRS had erred in denying our request, one would expect the agency to confess its mistake and quickly contact us to remedy the situation. But with journalists now asking questions, the IRS was hesitant to admit it had acted wrongly. In fact, all the press attention caused a bit of an office-wide freak-out.

Disclosure Chief John Davis responding to our press release and the resulting media inquiries on October 3:

Counsel A.M. Gulas after the Washington Examiner published a piece on October 4:

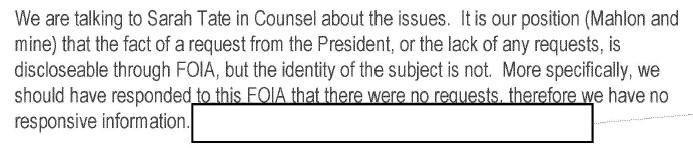

As the flames climbed higher, IRS firefighters worked to douse the blaze before it consumed their agency’s reputation:

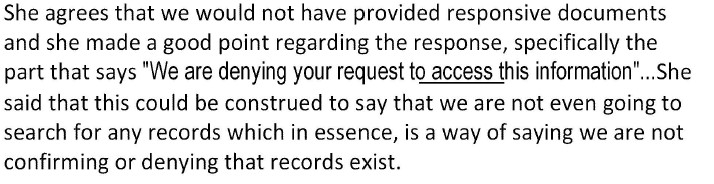

Counsel Sarah Tate came up with a creative way to spin their original denial:

If that explanation sounds largely incomprehensible, that’s because it is. By this point the IRS was grasping for any justification that would allow them to avoid responsibility for their error. In the process, they wasted a tremendous amount of employee time and taxpayer dollars defending themselves in a pointless battle they could have easily avoided some months previously.

As we often do, Cause of Action alerted media when we filed our lawsuit against the IRS for refusing to disclose presidential requests for tax returns. After Politico and the Washington Examiner ran stories, media began questioning the IRS for a response. Although Cause of Action had been in contact with the IRS regarding our FOIA request and appeal for months, they only revealed that no documents existed to the Washington Examiner and the Washington Free Beacon. IRS officials apparently do not respect the FOIA process or even the judicial system, but instead will cave to media scrutiny.

After finally receiving written confirmation in late November that no responsive documents existed, Cause of Action dismissed the lawsuit on December 5; by that time, however, the damage had already been done. Because two FOIA analysts failed to undertake a simple search and instead relied on their own inadequate legal analysis, Cause of Action and the IRS were both forced to spend time and money on needless litigation. Even after it became clear no records existed, the IRS continued to obsessively protect its reputation rather than admit its error and move forward. Unfortunately, it appears that one must sue to ensure that IRS analysts conduct searches with the diligence and oversight that FOIA demands.